A Trifecta: Reasons the US Would Attack Iran

June 19, 2025

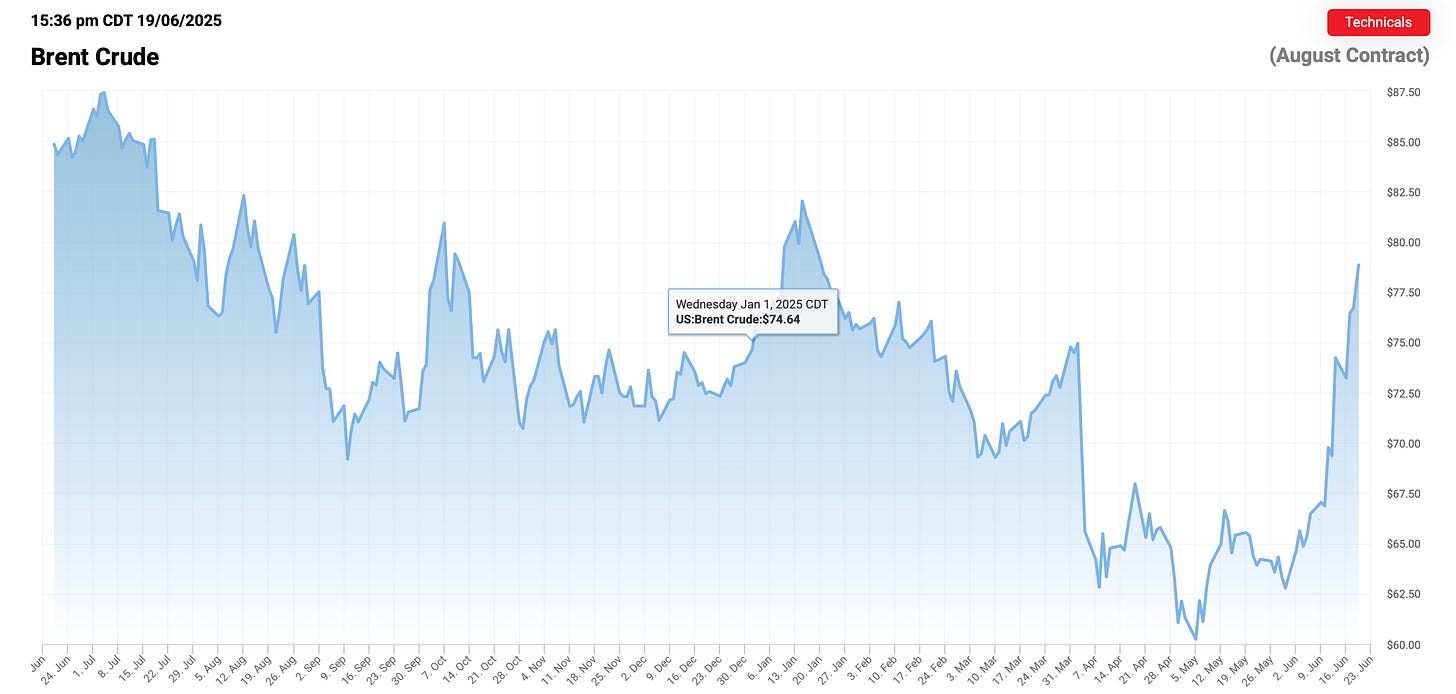

$10/barrel.

That’s the geopolitical premium currently embedded into the oil market right now as missiles from Israel and Iran fly towards each other. It accounts for the heightened tension, but lack of supply disruption (so far).

Israel’s attack on Iranian facilities has been well choreographed, and the initial surprise and careful planning has allowed Israel’s air force to achieve total air supremacy. The distance though (nearly 1,500km away) means that the flights are long and the strain on resources (maintenance, aircraft hours, crew fatigue/personnel) are exceedingly high, which leads us to wonder how long can the IDF sustain its the combat cadence.

As we know from the US’ own forays into the Middle East, air superiority alone can’t win wars. Boots on the ground do, but there’s no way the US will commit troops to another land campaign when there’s already so much consternation about joining an air campaign. Other than possible special operations raids, Israel also doesn’t have the manpower, resources, or willingness to do so.

Iran, is roughly 20% the size or the continental US, or the State of Alaska. Unlike Ted Cruz, we know there’s about 90M people living there, so about 1/4 of the US population. Iraq is a quarter of the size and half the population, and if you think that was a slog of a campaign, Iran’s on a completely different scale.

So air power it is, but for how long, and to what extent? We anticipate Trump will jump into the air campaign with Israel. Iran simply won’t capitulate under today’s circumstances. Given the losses already suffered by Iran, the leadership likely views the war as an existential crisis. Furthermore, survival of the regime is paramount, but in what form? We view it as exceedingly unlikely that they would agree to any form of “unconditional surrender,” they also wouldn’t agree to having uranium enrichment outside of the country. Without domestic uranium enrichment, the Iranian regime would have little chance to weaponize it and secure the future of the regime. So we’re not sure how the parties can chart a course through the impasse. As we also noted before, when things become personal and the issues fought over become existential, the agreements are tough to come by. Which reminds us, how’s that Ukraine / Russia peace deal progressing?

A Trifecta of Reasons to Strike

You can never discount President Trump’s penchant for deals though and his ability to backtrack (see “Trump Always Chickens Out” - TACO trade), but this one seems different. So really we see a trifecta of reasons why the US would strike: 1) voter support, 2) political strength, and 3) low oil prices.

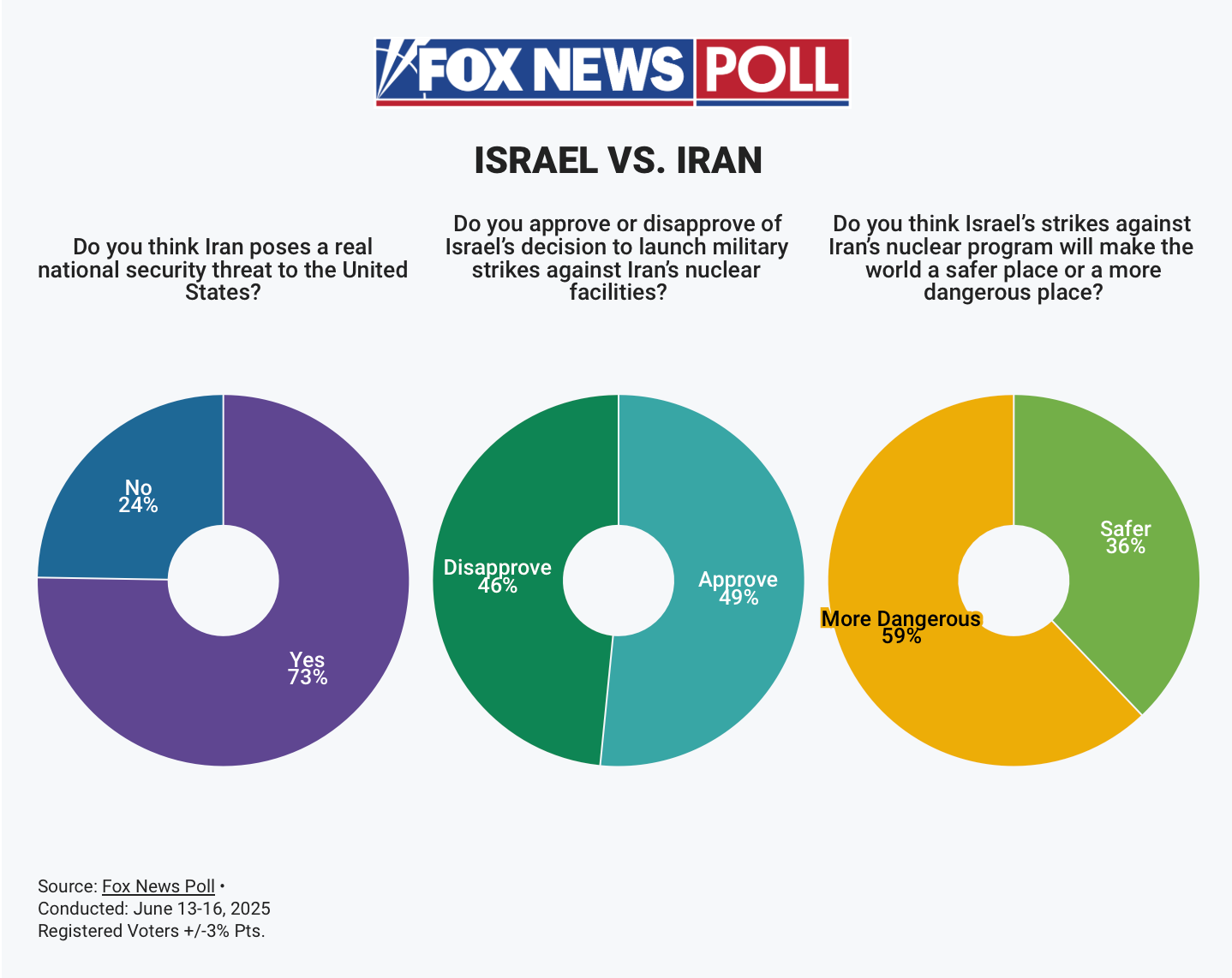

Here’s the first . . . most American’s believe that Iran poses a serious threat to the US. Ironically, it’s about the only thing we can all agree on these days as the issue crosses party lines.

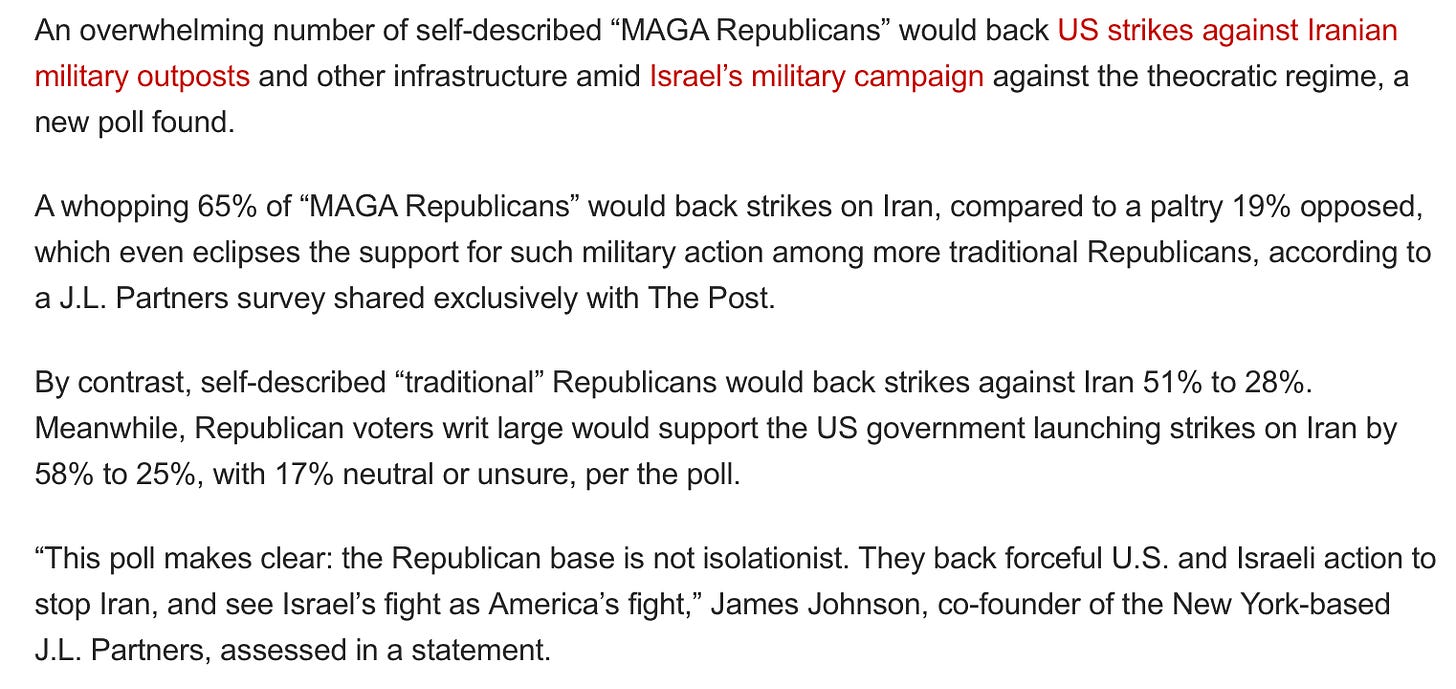

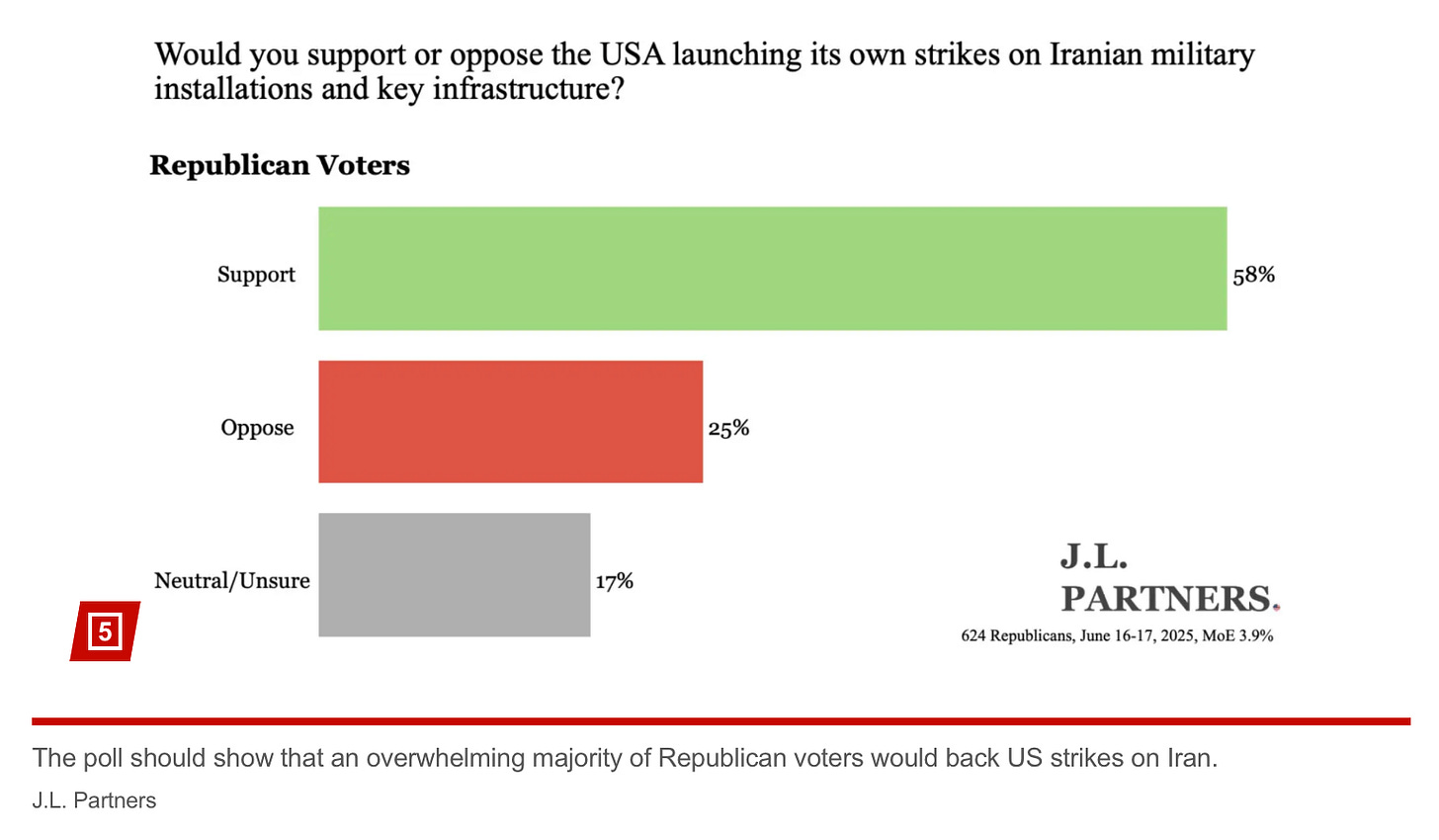

Dive deeper though, and ask whether voters support a strike? Republicans think so . . . and even the supposedly “isolationist” MAGA.

They’re the one’s that matter because they’re the ones that will vote in the upcoming primaries. So despite the Bannon, Tucker Carlson, and Marjorie Taylor Greene of the world, the base would support an attack.

Secondly, you add the personal factor. President Trump wants to be perceived and revered as a strong leader. The mention of TACO certainly vexed him, and no doubt has stayed with him in the following weeks. For a person fond of parades and the pomp and circumstance, dropping one of the largest non-nuclear conventional bombs on an arch-enemy plays right into his wheelhouse. It projects strength, and gives him a “policy win” amidst the trade/tariff war, fiscal/budget/tax battles, and DOGE/Musk set-backs. MAGA is built on a perception of strength, and nothing sells better than big beautiful bombs especially when the risks to US troops are low and Israel’s done the heavy lifting.

Lastly, oil prices. If it were not for oil prices, the US would’ve already green lit and Israeli attack on Iran’s Kharg Island, a tiny sliver of land from which Iran exports nearly 90% of its oil.

Today, Iran exports ~2.2M bpd of its oil, mostly to China.

Kharg is Iran’s economic tenterhook to the world, and the oil trade funds the government and its proxies. Cut-off the source of that funding, and you’ll see the regime collapse, yet doing so also means oil prices in the triple digits. OPEC+ (and really the Saudis) would step-in to back fill that amount, but prices would still spike as spare capacity dwindles to nothing. So that won’t happen, unless a tail risk event drives us there.

For all that, oil is still “only” at $78/barrel for Brent, a few dollars higher than the start of the year, with projections that inventories will build in H2. If the US were to attack only nuclear facilities on the weekend, then the market implications for energy would be muted. Rising from $78/barrel is a lot different than if we were rising from $90/barrel, so there’s room to economically absorb the impact.

Moreover, if the US were to strike more broadly (i.e., military, political, and non-oil targets), it could destabilize the Iranian government enough to foment/induce a regime change. In a rosy Syrian scenario, a new Iranian government could reduce tension in the Middle East, and invite Western economic investment (juicing supplies). It’s much further down the road, but a possibility, and one that means any additional bump to the oil price risk premium may be outweighed by the longer-term benefits of a regime change. Guess who’d get to claim victory for that? Yeah you guessed it.

Can’t We All Just Get Along?

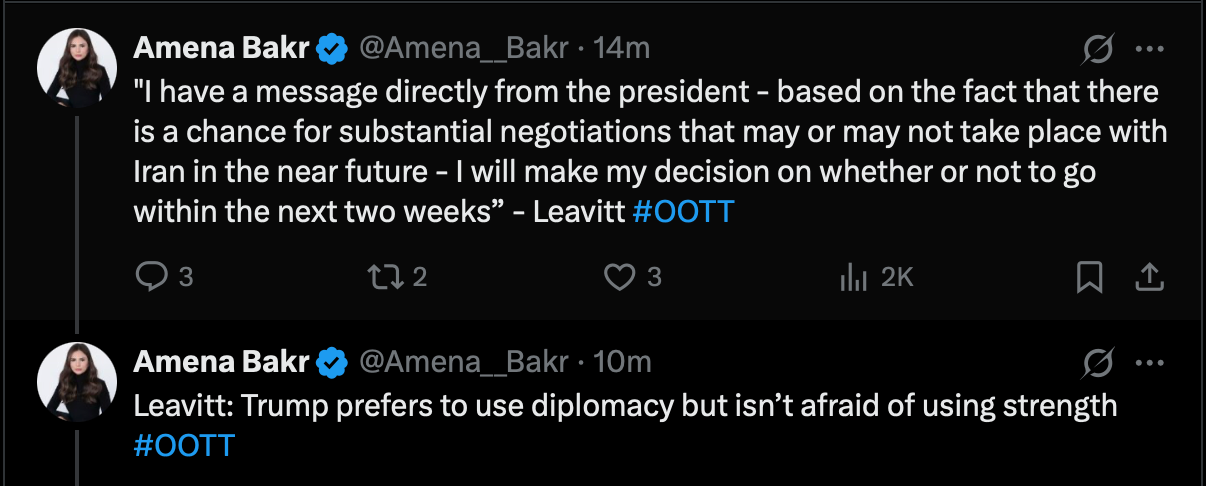

What if we gave peace a chance?

Well that sure sounds positive. Yet, that statement issued today, may just be subterfuge as the US positions its military assets and plays for time too. We wonder what can be accomplished at this stage. Remember, Iran and the US have been negotiating for 60 days to no success, and right at the end, Israel launched a devastating surprise attack, sanctioned by the US.

If a breakthrough was to be had, wouldn’t it have come already? Now we expect one while Tehran burns? Doubtful. Unconditional surrender? Unlikely. Play for time while a gun’s pointed at your head? Absolutely.

So all in? Yeah . . . we think the US is coming, at least in the short-term. Eventually, we’ll run out of things to bomb. We certainly won’t level a city like Israel’s done to Gaza, but we will run though a week long target list. This is a chance to degrade and diminish Iran’s future capabilities, and once the US/Israel was willing to open the can of worms, it’s game on.

Eventually the dust will settle once we run low on targets. The operational tempo will decline, and we’ll find ourselves in a war of attrition. We continue to assume that the US won’t conduct a decapitation strike on the Ayatollah. While it could topple the regime, it would certainly become a rallying cry for many in the Middle East as martyring a religious figure would inflame passions. A war of attrition though means we drag on. Tensions will simmer down as missile strikes decline, so some of the $10/barrel geopolitical premium will bleed away (we don’t think it will be completely gone as the threat of “what’s possible” remains). We expect a high-$60/barrel in such a scenario.

What matters though are supplies, and so far they haven’t been disrupted. Oil flows from the Middle East remain uninterrupted. OPEC+ will continue to unwind its voluntary cuts, and US production will keep degrading. We doubt any producer will increase capex at this stage given the uncertain backdrop. A tweet from the President could dramatically alter the direction of this conflict so producers will largely pocket the extra cash flow today, hedge some production in H2, and/or say thank you.

The above of course is predicated on the information we have at this stage. This is fast moving, and there’ll surely be surprises ahead, especially as we head into the weekend.

So while Israel may have kicked it off, the US sure love winning teams. Here comes the Israeli bandwagon, we think the US will jump on.

Please hit the “like” button and subscribe if you enjoyed reading the article, thank you.