Can Trump and the Market Thread this Needle?

March 30, 2025

Woo wee.

That’s a small hole. What’s that you ask?

This.

That’s the eye of a needle. Tiny.

It’s about the size the Trump administration has to thread this economic global economic realignment. Raise tariffs, “level the trade barrier” playing field, restore US manufacturing, weaken the US dollar to encourage exports, and deregulate the economy, reduce taxes, shrink the size of the US government, and reduce interest rates. Whew.

Do that all without crashing the global economy. That’s it? Easy-peasy and just a few tweets will do. Yeah, we’re not so sure about that, and if you actually just start playing through some of the implications of what they’re trying to do, it sure makes us uneasy.

Well let’s level-set. Let’s take a drone and fly higher so we can get our bearings.

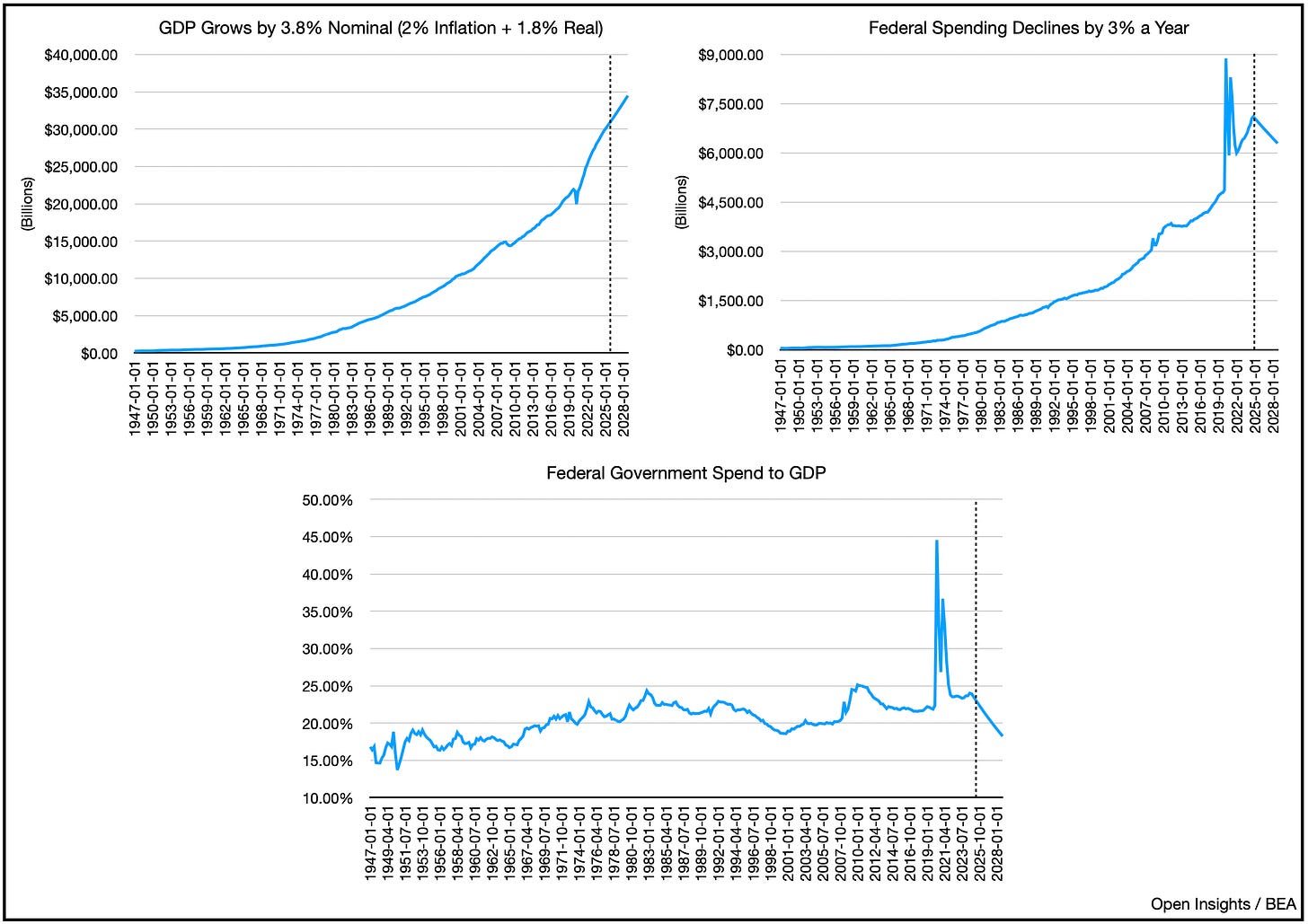

US GDP, our entire economy is about $29.7T. Give or take $30T. That’s a “T” for “trillion.”

Federal government spending clocks in at about $7.1T. So basically, the federal government spend corresponds to about a quarter of GDP, ~24% to be more precise. Historically, the federal government has spent ~21%, but with COVID and the years after, we’ve blown that out and spend ~26%. 5% doesn’t seem like much, but man, that’s nearly $1.5T dollars more in today’s dollars.

Obviously we don’t collect nearly enough tax receipts at the federal level, so at today’s level, we’re running a 6.5% deficit. Eventually all that debt piling up isn’t good, and eventually all that debt would/will lead to the downfall of our economic system. Most people can agree on that, as our federal debt has climbed to about $36T.

So what’s the plan? Well Secretary Scott Bessent has laid it out. By 2028, the Trump administration plans to shrink government spending to GDP (i.e., the size of what we spend publicly to the size our our US economy) down from today’s 24% to ~18%. In turn, our deficit spending should fall back towards our longer-term average of 3-3.5%, something much more sustainable.

Okay so let’s play around with figures. If we assume GDP (our economy) will grow 3.8% (2% inflation + 1.8% real growth, Sec. Bessent’s assumptions), GDP by the end of 2028 will notch $34.5T. In turn, if you shrink federal government spending by 3% a year, and assume that the $200B a year in federal spending cuts wouldn’t affect GDP (I know, just suspend disbelief), we’re looking at an 18% federal government spend to GDP by ‘28.

Voila. All’s happy and well. Is it though? If you change any of those assumptions, the target doesn’t get hit. Lower GDP growth, bump up federal spending, or heck have a recession, and you won’t get to that 18% goal. Perhaps it’s not a hard goal, but reaching for it will have some profound consequences.

Just take cutting federal spending and what the Department of Government Efficiency (“DOGE”) is trying to do. Again, today the federal government spends ~$7.1T. If you cut that by 3%, that’s $200B of spending cuts. As a rule of thumb, $300B of a $30T economy is 1% of GDP, so cutting even $200B/year of government equates to about 0.7% of GDP drag every year for 4 years. As you’d assume, such out that much spending from the economy, you’ll see GDP growth shrink. So that 3.8% of Nominal GDP growth drops to 3.1%, and we don’t hit our targets. More importantly, there’s probably a multiplier effect on that number since private industries, local economies, etc., depend on the funding, employee paychecks, etc., which means the implications are even greater if the administration achieves its goals.

How close are they to doing that? Well, disregarding Elon Musks’ hyperbolic claims, the costs savings so far are debatable.

So far, there’s little evidence it’s on track, but to be fair it is early days. What could be coming would be significant reduction in force (i.e., federal government layoffs). The Washington Post has reported that the administration is really planning to cut 500-800K employees from the current 2.5M federal government workforce (note this excludes 600K of Postal Service workers). Said another way, we’re looking at shrinking the number of federal government employees by 25-35%. Assuming each makes even $150K with benefits, you can quickly get to $75-100B of run-rate savings, not to mention any any secondary savings with contractors, etc. So you could get to $200B a year this year, and then continue to cut more (or just hold spending flat and let inflation do the heavy lifting for the outer years).

In reality though, however, you game it out, you’re going to need GDP to grow here by 2-2.5% (likely the higher side), which means nominal GDP needs to rip upwards to 4-4.5%.

That sure is a balancing act. You’re hoping that as the public sector slashes and burns, the private sector will pick up the ex-public workforce while enjoying a boom as regulations fall. Would private industry hire more people if the macroeconomic backdrop really deteriorates? Not sure. Moreover, will lower financial regulations lead to lending picking-up? Again doubtful if business and consumer confidence starts to get impacted.

Anyone want to borrow for long-term investments while things are changing at lightning speed? . . . Anyone?

Fading Consumer Sentiment

The truth is consumers and the markets abhor uncertainty. So how plausible will it be to slash and burn the existing federal government and world trade system without crashing the economy? Unlikely, after all, the economy is the collective animal spirits, and certain wealthier animals have been keeping us afloat.

We’re top heavy. The “rich” continue to spend, but if the market starts declining, the wealth effect will reverse, and consumer purse strings will tighten.

Two weeks ago, we posted the data about debt to disposable income, and they’re all within range. Though consumer debt levels are doing well, we’re beginning to think they won’t matter as much if the wealth effect reverses.

Why wouldn’t consumers get more conservative? Stock market gains, coupled with higher interest on savings, and inflated paychecks along with locked low interest rates on elevated home prices means the wealth effect is real, but if we suddenly excise 0.7% of GDP and say secondary effects are 2-3x that, there’s going to be severe implications.

Mind you, none of this is taking account any trade impacts. We’re only talking about the federal government cuts.

Need another example of consumer pullback?

Savings are starting to go up (left chart). On the right chart we can see consumers tend to save more before recessions (grey bars) come around.

So the current situation is precarious. Everything is relative, and if the market is still near its highs based on AI euphoria, tariff war diminishing, and a strong economy, when the real hammers fall (i.e., federal spending cuts and tariff policy increases), coming off of those new highs will feel “decidedly worse.”

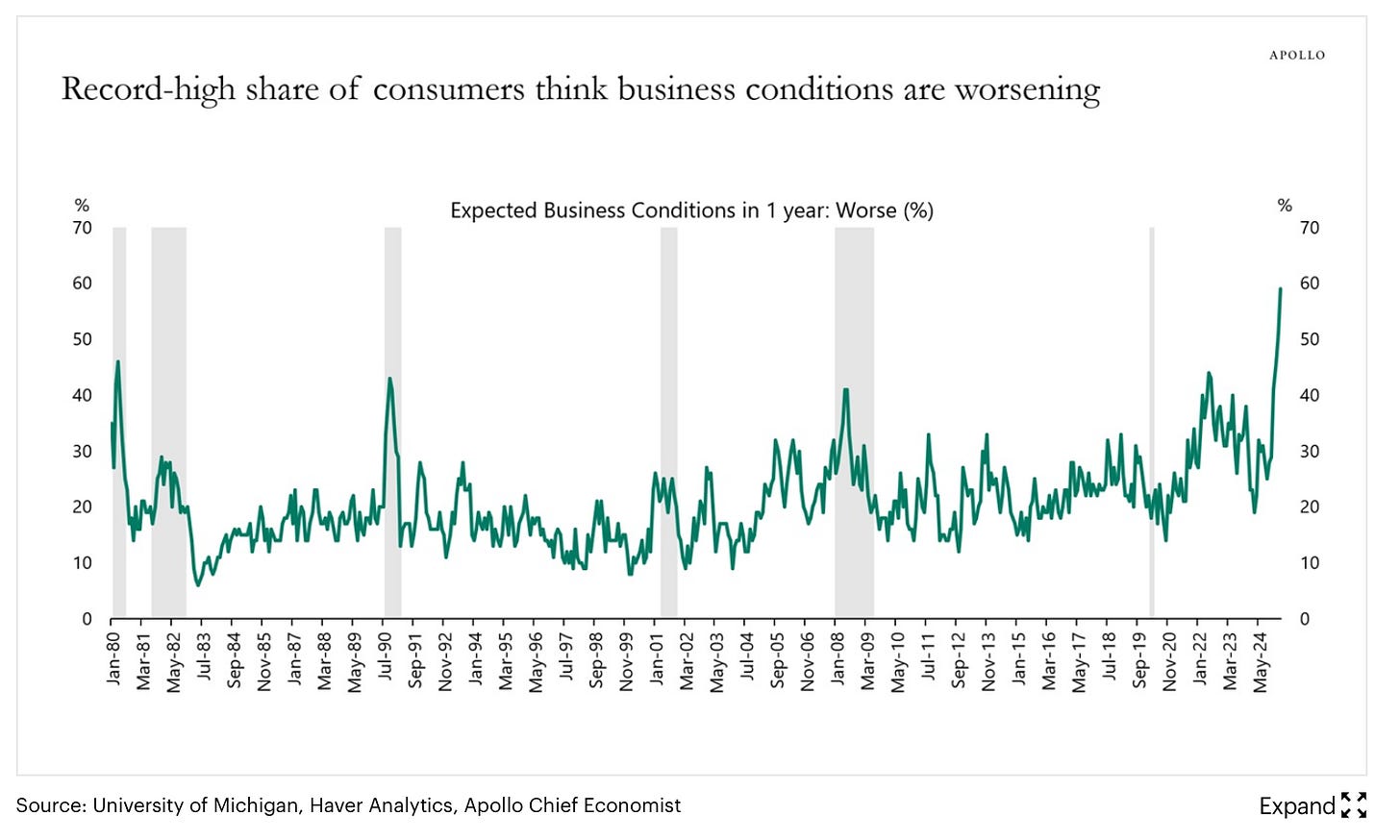

Expectations change and the highs no longer feel as high. Though consumer sentiment is very much correlated with political party affiliation, if you cut across party lines and look at income strata, we can see it’s deteriorating. Here’s Apollo’s Chief Economist . . .

Rough Road Ahead

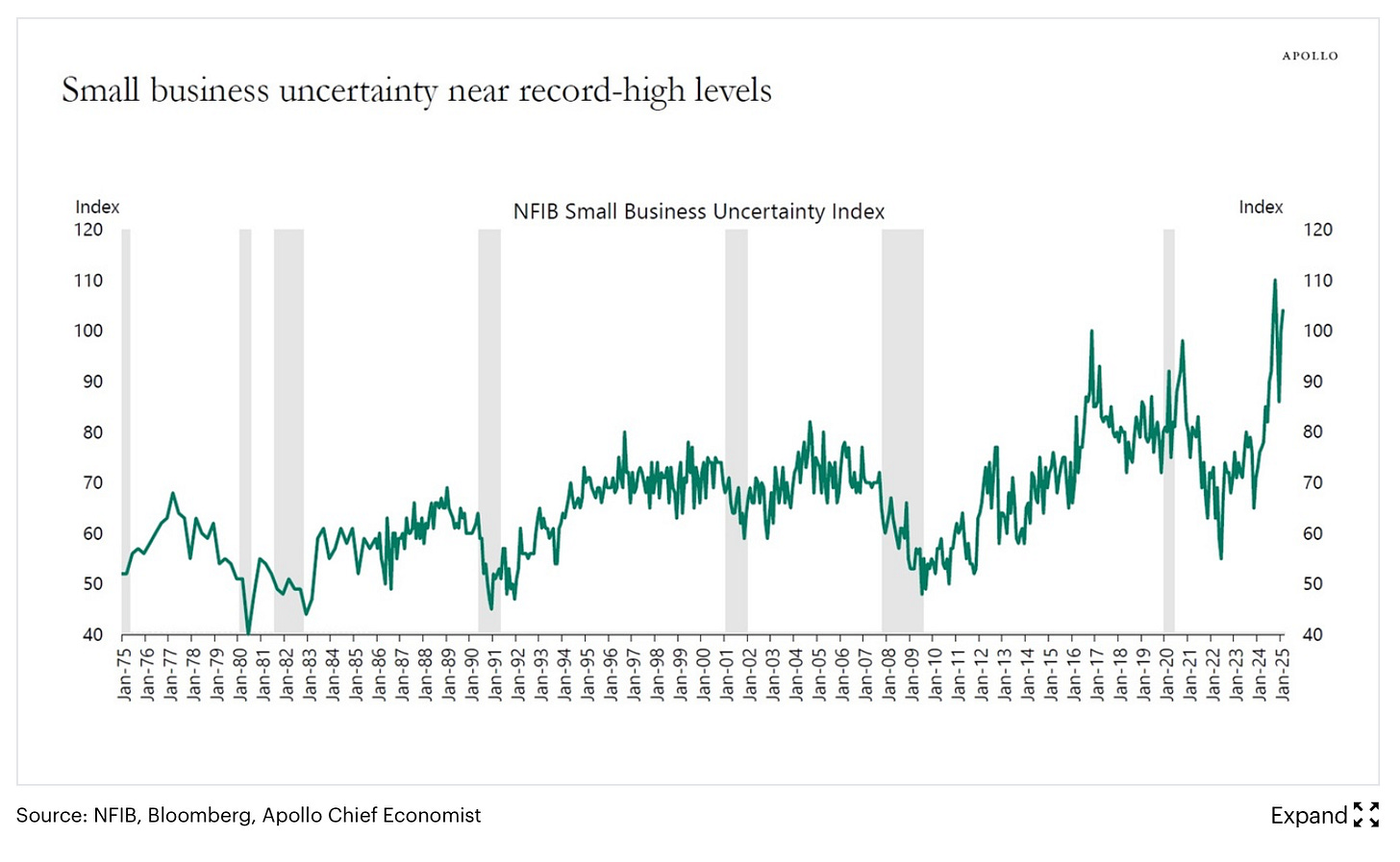

Unsurprising given the on-again/off-again uncertainties ushered in by DOGE and the trade war, which will begin to ratchet higher on April 2nd, we might be nearer the beginning of this rough patch than the end. To clarify, we mean that the trade war “fully kicks off” on that day as reciprocal tariffs go into place. Sure it’ll be adjusted, and there will be allowances and exceptions granted, but holistically, it’s when the rubber really hits the road, and resolving this stuff will take awhile.

Just look at Canada. Canadian Prime Minister Mark Carney has called for snap elections in Canada on April 28, and his party’s poll number have improved as nationalism has swept-up Canadians after the imposition of Trump’s tariffs and improbable push to make Canada the 51st State.

How quickly will Canada come back to the bargaining table, when taking an aggressive stance benefits the incumbents politically? If anything, expect movement after April. You can almost say the same for the Europeans, the Chinese and everyone else, who’ve all hit back in small ways, and are withholding their economic retaliation until post-April 2nd. The world’s no longer shocked by Trump’s actions, though they are still having an impact. The difference is the response this time. Who can endure the economic suffering for longer before the political pressures overwhelm. Very little of this bodes well for risk assets, and even before this week’s sell-off, they were still quite “elevated” as investors were hopeful that the tariff tit-for-tat will dissipate.

Now compare that to what the consumers and small businesses (who employ 80% of the US workforce) are thinking.

Between investors, the consumer and the small business operators on the ground, someone might be off, and we’re not entirely sure it’s the latter two.

It’s sure a small hole to thread for this administration, and we’re about to see if they can thread it. Unfortunately, that hole just might be shrinking in the days to come.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

No