Just How Sturdy Are the Consumers' Boats?

March 14, 2025

We get it. It’s scary out there. S&P 500 entering “correction” territory. NASDAQ nearly 15% off of its highs reached only a few weeks ago. Volatility happens, and the repercussions to the overall market and your portfolio can make you think the market’s about to fall apart. Could it? Certainly could from the way the Trump Administration’s talking about it.

Offering little solace as Treasury Secretary Bessent keeps repeating they’re not looking at the near term market volatility. They’ve got bigger fish to fry. What’s that you ask? Well basically a multi-prong strategy . . .

Weaken the US dollar to make US exports that much more attractive as they cajole manufactures to onshore production in the US.

Lower interest rates by squashing inflation. Squashing inflation means reducing government spending which is driving up demand, and overall consumption. If demand falls, so too should prices, thereby reducing inflation. Doing so will allow the US to refinance its short-term debt and reduce the interest burden. Once inflation is tamed, the Fed can finally lower interest rates to spur the economy.

Lower oil prices, as energy inputs costs are a large factor in lubricating the broader economy (and inflation).

Eventually what you get is a fertilized environment ready to plant the seeds of growth. Low rates, low energy prices, and a weakened currency.

Still squashing inflation (i.e., #2) can’t come without causing some pain. Just see the DOGE cuts to federal government jobs. Moreover, the trade war, which if we’re being generous, is specifically “calibrated” to create chaos. Who can commit to large purchases, home remodels, buying goods big and small when you’re livelihood is threatened and you don’t know what the price of goods or services can be from this day to the next. Hence the uncertainty is causing plans/timelines to become shorter, investments to decline, and confidence to wane.

People will begin to cut back on everything.

All of the uncertainty got us thinking though. What happens after? Our working assumption has been that since people have lived through Trump 1.0, they’ve learned how's to cope/react in Trump 2.0. US increases in tariffs are now being met with reciprocal tariffs. Not blanket ones, but one designed to specifically hurt Trump’s political base (i.e., Canada’s proposal to apply a 25% tariff on energy sent to Michigan).

All of this means that if it took a year or two under the last administration to unwind the chaos (i.e., transition from trade wars to trade agreements), we think the timeline today may be accelerated because counterparties have learned to play the game. If the trade war does subside, one that coincides with flatlining inflation and lower rates, can the economy and asset prices recover quickly? We think so.

The consumer’s the key here. As their spend largely drives the US economy, if macro headwinds abate, they can begin flexing their spending again. While sentiment may be depressed, that can change quickly.

So where does the US consumer stand? Well savings rates are still low in comparison to historic levels.

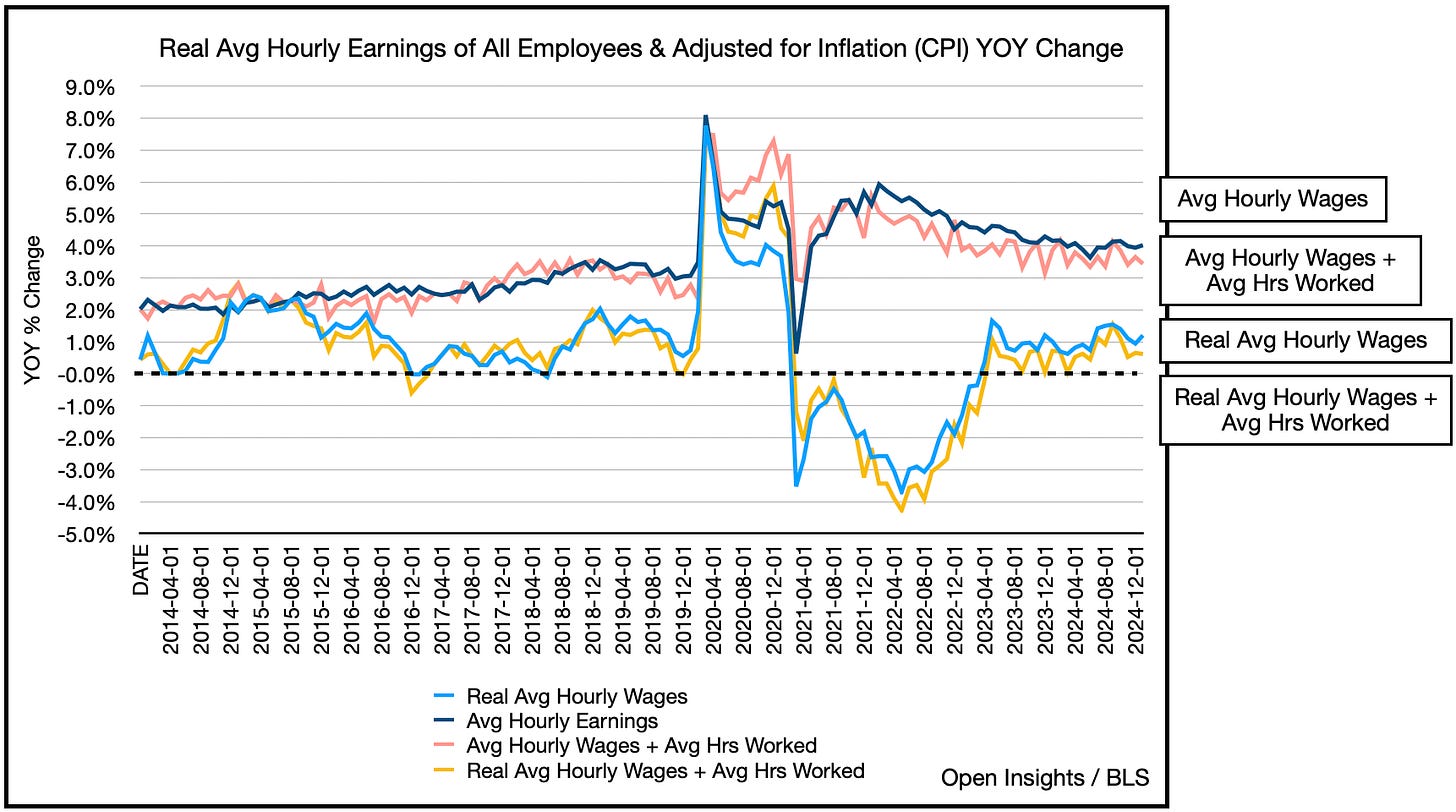

Income growth though is still keeping pace, and in fact exceeding inflation by a bit.

The ability to earn income is drive by the job market, and for now it remains robust as job openings exceed the number of unemployed workers.

This explains why despite headlines of massive government employee cuts (federal government to be specific), unemployment insurance claims have been relatively stable.

Don’t believe the claims? What about more “real time” indicators. Ones that are updated daily. Well let’s look at two of them. Daily payroll withhdolding, you know, that pesky FICA and FUTA thing sucking workers’ money before their paychecks land in their bank accounts. Well that’s actually been increasing year-over-year.

If employment was weak, and layoffs abounded, we should see employee withholding taxes decline.

What about websites with job listings. Indeed.com postings seems to have flattened out, but not deteriorate.

What about debt? Are consumers heavily indebted? Well, consumer loans (i.e., credit card debt, etc.) relative to disposable personal income have actually been declining. Said another way, increasing incomes are outpacing the growth of debt.

Overall if you toss in mortgages, total household debt as a % of disposable income is declining.

Default rates (i.e., the % of loans going into default) are flattening as well.

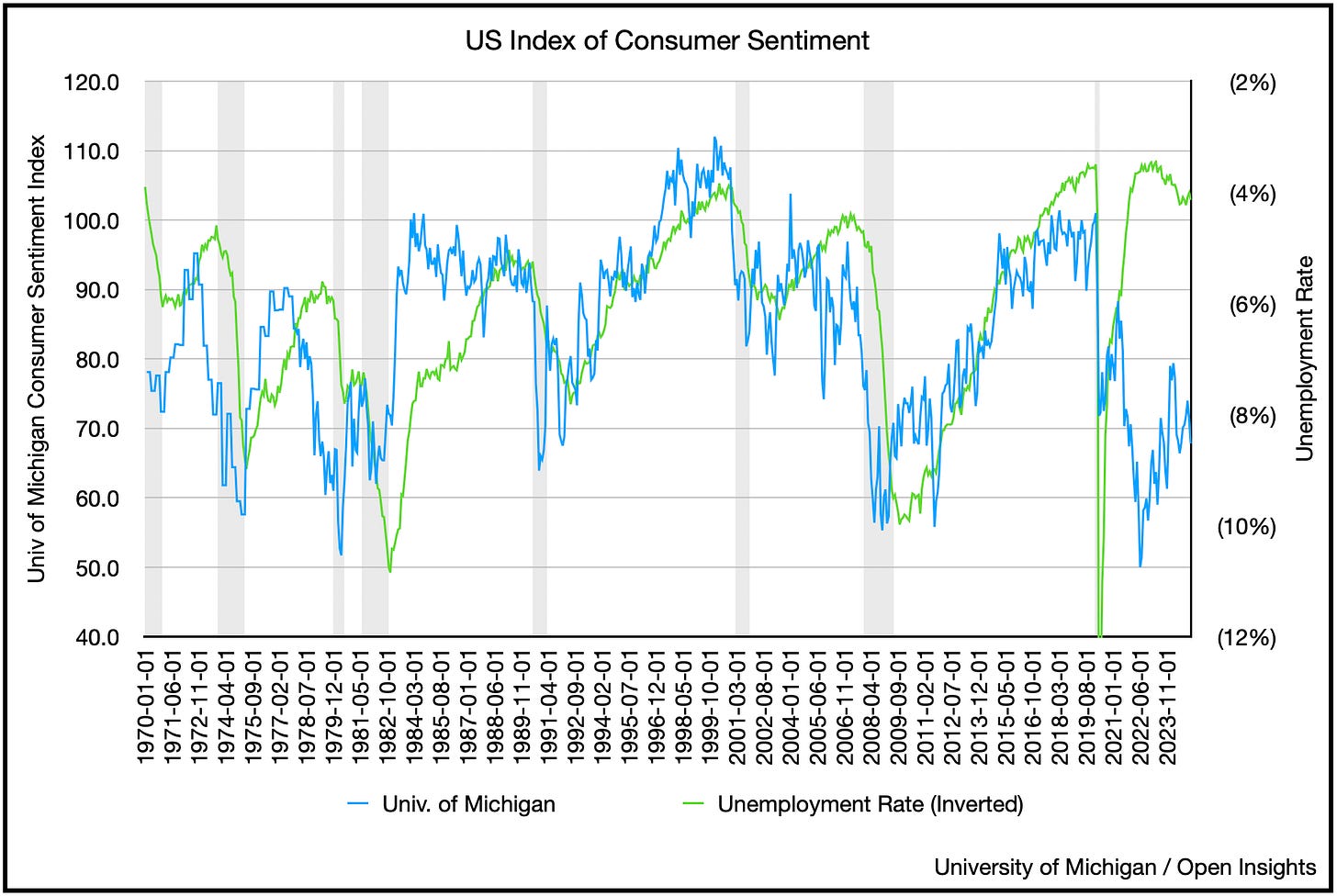

You’d think the above, low unemployment, higher wages outpacing debt, would translate to a happy consumer, but that’s not currently the case. Consumer sentiment is in the doldrums. Historically, it’s tracked unemployment rates, and given the low unemployment rates, we’d expect to see higher consumer sentiment.

So there’s certainly a wide divergence here. What’s notable though is as we’ve become increasingly politicized, there’s a growing divide between Republicans, Democrats, and Independents. As you’d expect, whoever’s party is in charge seems to be coloring people’s views.

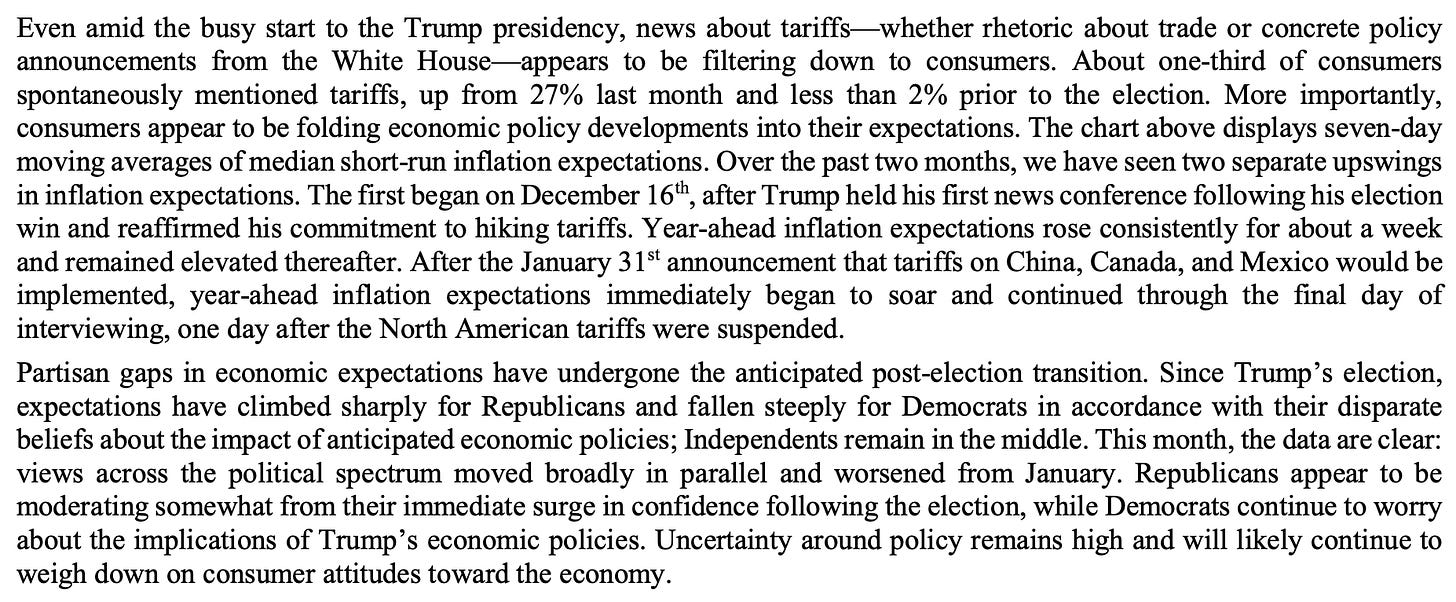

Cause of the inflation expectation divergence? Tariffs.

Here’s the University of Michigan’s deeper dive explanation.

So yes, as we’re all trying to find our way through the maelstrom of swirling tariffs, know that much of your perception will be colored by your politics. Having said that, the uncertainty of it all will begin to play into corporate/business planning on the operational side and capital expenditure side.

Think about it, it’s increasingly difficult for a multinational company trying to forecast what their operating expenses will look like for the year if they’re uncertain about whether tariffs (and by how much) will/will not apply. That uncertainty, whether you are or are not Republican, naturally means you’ll be conservative. It means forecasting lower revenues and higher operating expenses (just in case), which means lower profits and lower planned capital expenditures (i.e., investments made with benefits lasting longer than a year). Lower profits, lower capex eventually means lower spend and lower headcount for you and your service providers. A company, big and small, can withstand the uncertainty for a period of time, but give it longer than say 6 months to a year, and then we’ll start to see a real drag on the economy. You’re already seeing stocks price-in the uncertainty as it typically looks 6 months to a year out.

This is after all what the administration wants though. Tame that consumption, reduce government largesse, and lower inflation to lower rates. For now, consumers are fairly healthy, so we’ll be able to hang in a bit. We can withstand the pressures given our high incomes relative to our debt levels. Unemployment rates just can’t spike materially. If tariff and macro headwinds fade, then consumer sentiment can/will turn quickly given the healthy individual balance sheets.

What we need are trade tensions to calm down, or enough so so that they don’t dominate the headlines so companies can plan with some certainty again. Given the longer term goals of this administration, that may not come for a few more quarters. It took about 2 years for the US/China to enter into trade negotiations last time, and we think it’ll be shorter this time as politicians and technocrats have more experience post-Trump 1.0.

Still, brace for a bumpy ride. Fortunately, our boats are sturdier than we perceive . . . even if you’re not Republican.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

the market could easily over-correct to the upside if :

- trump ended tariffs and declared victory

- actually get more biz tax cuts passed

- beg for rate easing or other stimulus

and i am confident that trump will as soon as there is 'enough' in it for him & cronies.

outside of societal damage and cultural signaling, the regulations rollback and MAGA budget cuts have been insignificant to excite animal spirits.

Well argued. the end is not nigh