Just Got Paid, Friday Night, Chairman Powell . . . Feelin' Right

September 20, 2024

What a flex.

We saw that Chair Powell.

Can we call you CP?

You with your big fancy words.

Dripping each syllable out to the market like monetary catnip.

50 . . .

basis . . .

points . . .

cut . . .

oooooh. Flex on monsieur.

Flex. On.

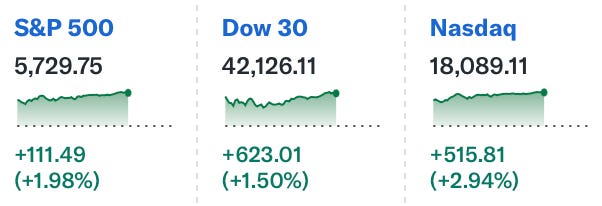

You like that didn’t you, Mr. Market? Rates now hovering around 4.75-5.0%.

Yeah you did.

After yesterday’s mini-selloff/head fake, today you got religion. Yo-lo-ing back into stocks, especially tech, with all the carrying capacity of a Ford 150.

‘Murica.

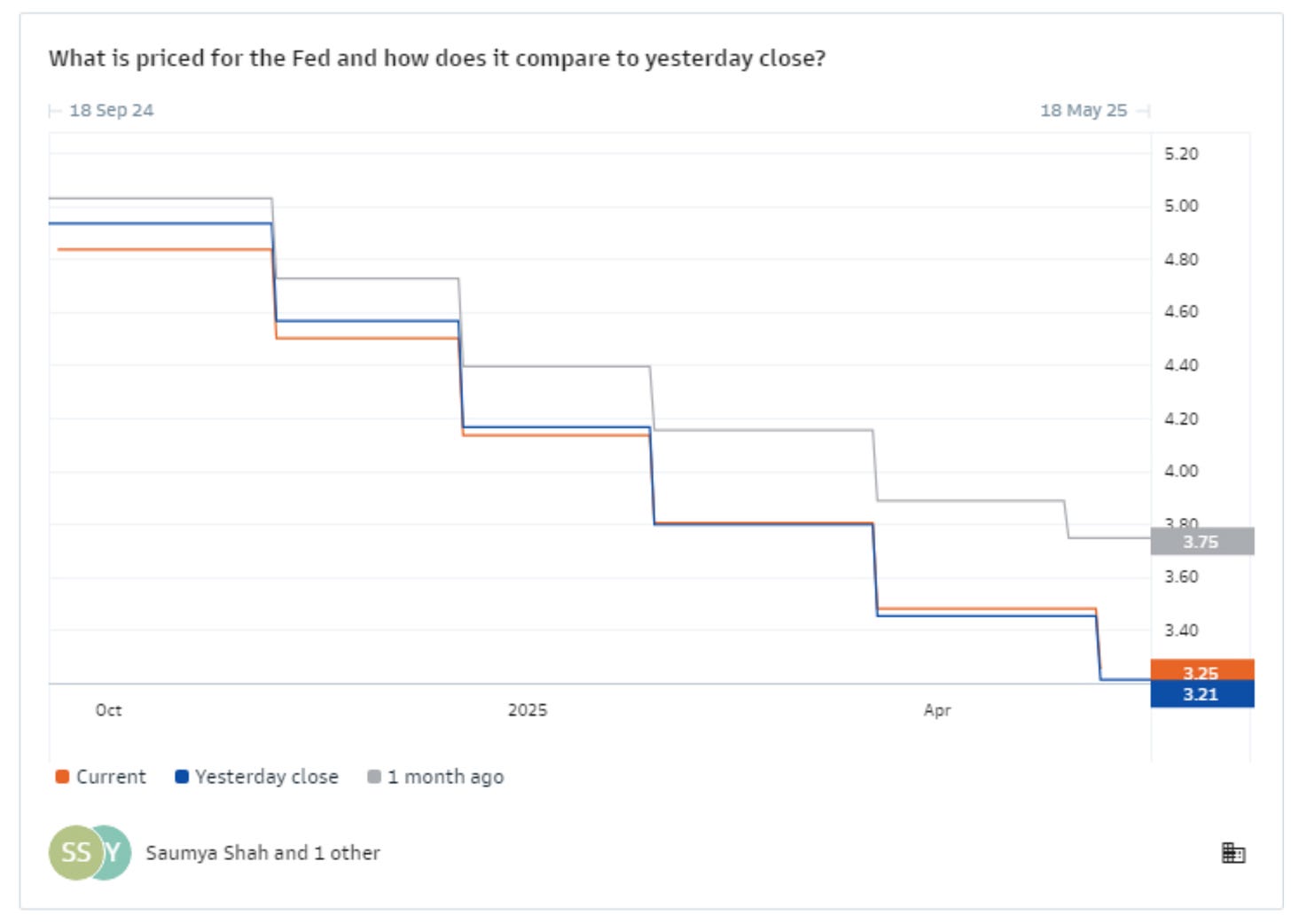

Wait, there’s more to come though. Heck just look at the dot plot (i.e., the Fed’s Summary of Economic Projections). You know, that Fed survey of governors for “what do you think about future rate cuts?”

Apparently two more I see, bringing rates all the way down to an average of ~4.4% by the end of 2024. That’s huge.

Interest rates coming down by a full percentage point ripples through everything. By end-of-2025, we could even see rates around 3% as the Fed gets closer to “neutral” (i.e., where rates and inflation are around the same level).

Maybe we should call you CP3 then.

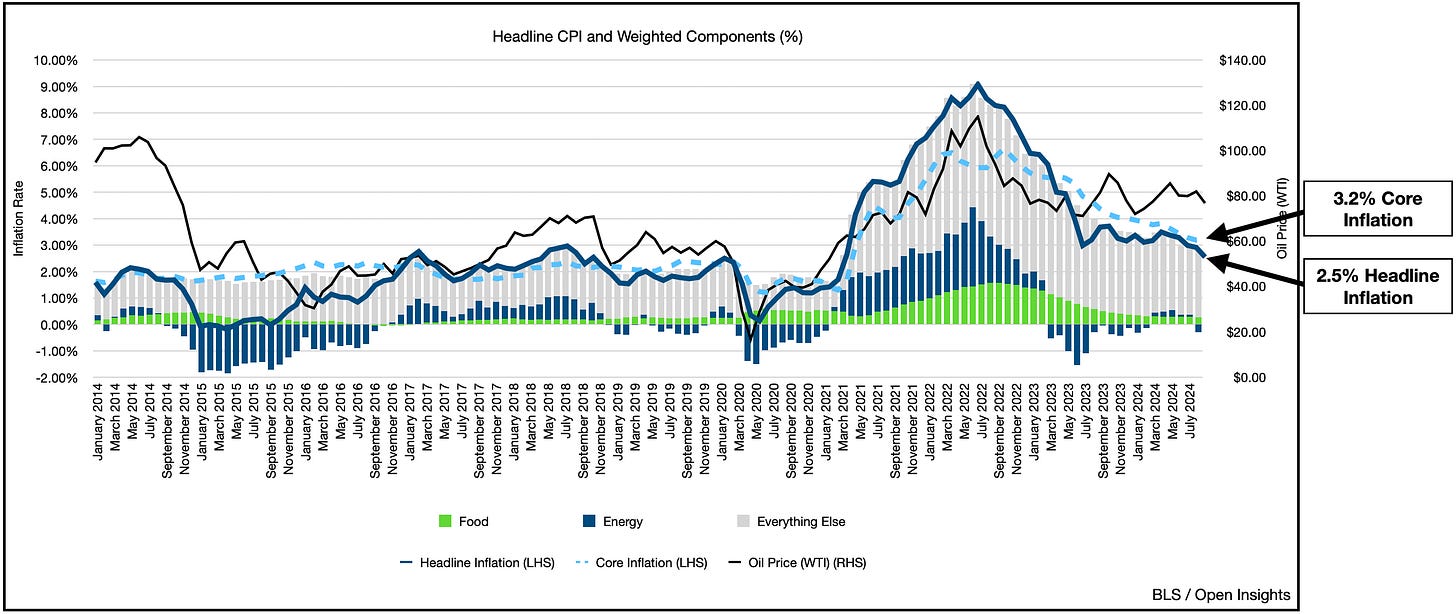

Since headline inflation is running at 2.5%, there’s a long-way to go to achieve neutrality (since even after yesterday’s cut we’re still at 4.75%-ish), but the 50 bps cut was certainly welcome . . . and in our view needed, as the overly tight conditions had started to slow the economy.

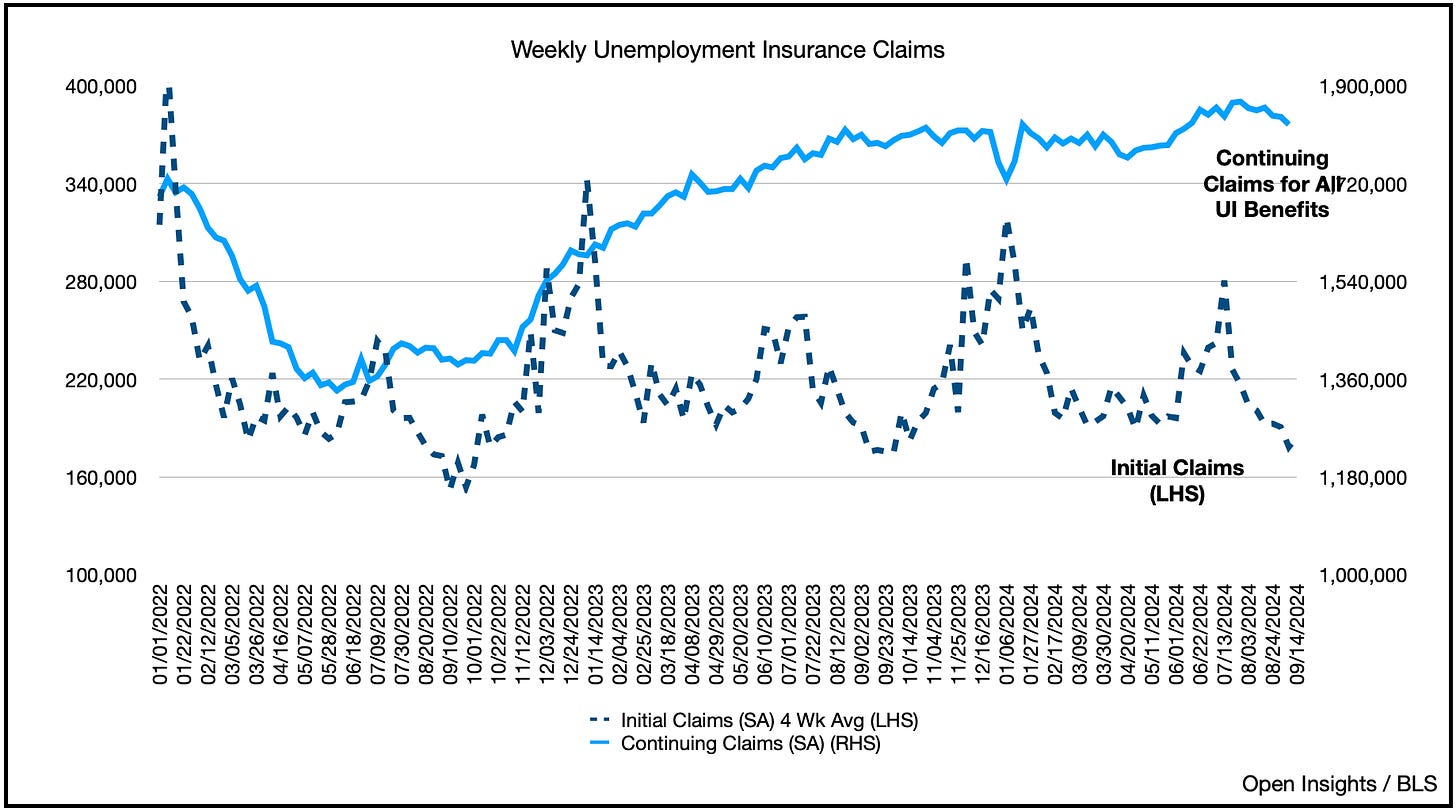

Despite the tight financial conditions, we’re seeing a resurgence. Even before the rate cut (and admittedly to our surprise), employment has held up much more favorably than we anticipated.

New job listings are actually up and job listings overall have flattened out.

In addition, the unemployment claims have stabilized.

Continuing claims have even dipped since we last looked, and after a spike in initial claims, we’re seeing them fall as well.

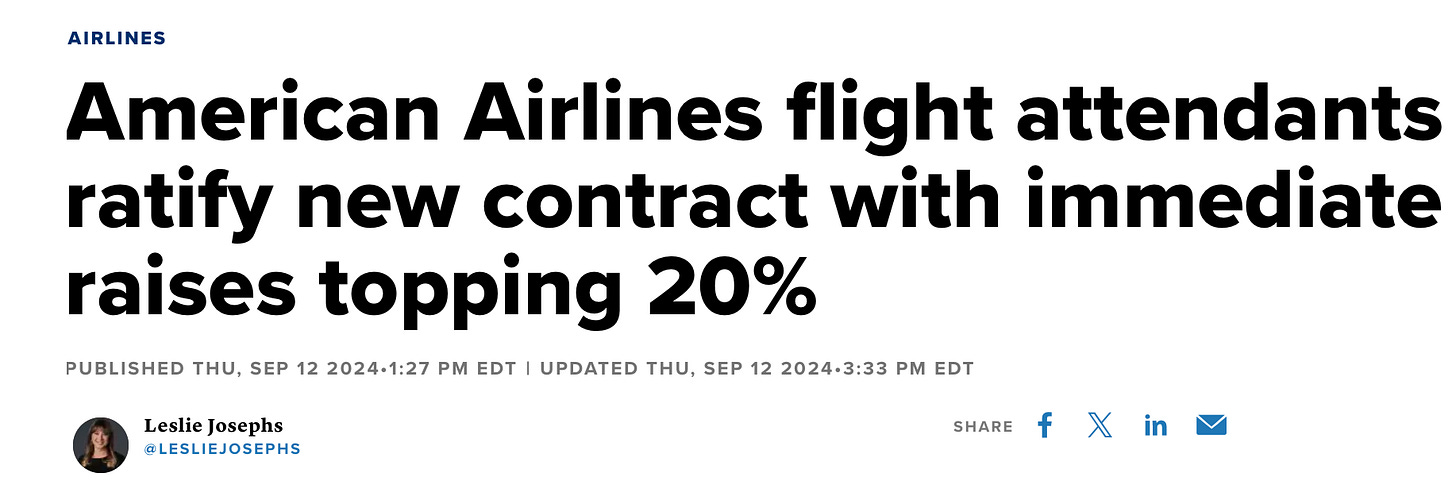

Moreover, it seems so many people are getting raises.

Flight attendants are getting 20.5% immediate raises . . .

It wasn’t just 20%. For the next few years they’ll see “. . . annual raises of 2.75%, 3%, 3%, and 3.5% after that.” If you ask me, they deserve it since they have to deal with us. Other people who’re getting a taste?

Amazon workers getting $1.50/hr bumps to $22/hr (i.e., $45K a year) . . .

“Amazon said the $1.50 an hour pay hikes will bring the average base pay for warehouse workers and delivery drivers to more than $22 an hour. Amazon is also kicking in free Prime memberships, valued at $139 a year.” Free Prime! Nice . . . by-the-by? Amazon employs 1.5M workers, and about half of them fall into the warehouse category. Nearly 800K workers just got a raise.

Then there’s these guys/gals . . .

As Boeing union workers (30K of them), rejected a proposal to increase wages by 25% over 4 years, in an attempt to get 40% raises. Said another way, they’ll get at least 25% wage increases over 4 years . . . the question is how much more as the strike continues? Let’s say they land somewhere in the middle, 32%? Give or take 8% a year? Not too shabby . . .

So flight attendants, warehouse workers, union workers in the manufacturing space. We’re looking at almost a million workers here collectively getting significant raises. We’re not saying they are, or aren’t well deserved. What we’re saying is that if you get (and companies are forced to GIVE) a 5-20% immediate raise . . . how strong is the labor market really?

Furthermore, how does this make any sense?

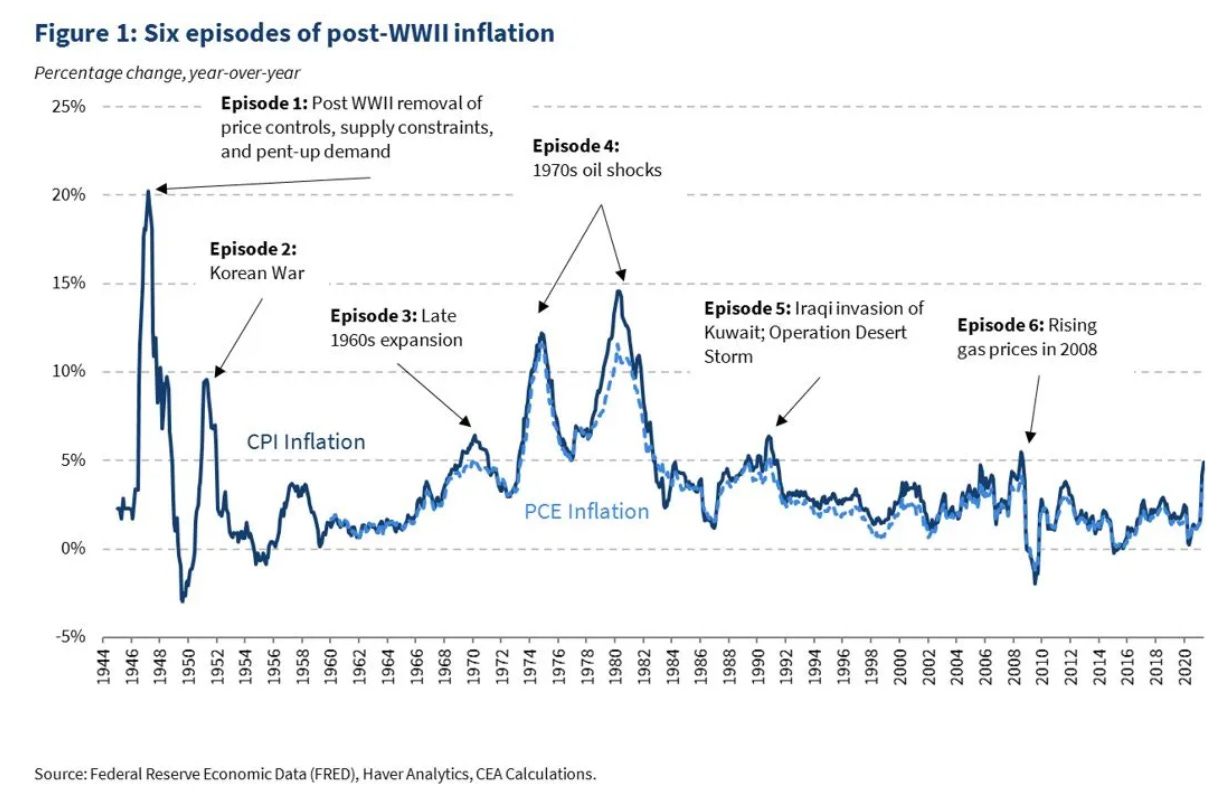

Headline inflation is running at 2.5%, and core inflation (stripping out volatile food and energy prices) at 3.2%. Yet, everyone’s getting raises higher than that.

. . . and again nearly a million people just got FREE AMAZON PRIME. Y’all don’t think they start ordering stuff?

We kid, but maybe not. What wouldn’t be entirely surprising is if inflation picks up again. So as the Fed lowers rates (or at least what the market anticipates the Fed to do) . . .

. . . inflation might head the other way. It’s hard not to spend more when you make more, and we sure as heck aren’t saving more . . .

So begins the chase. Like the real Chris Paul (i.e., CP3), Chair Powell has just passed the ball. Yes, they’re starting to drop rates to shift monetary policy from tight to neutral, but the Fed’s also doing it while the labor market is tight enough that workers are getting material wage increases. Now we’ll see over time if inflation comes back, because if it does, will the Fed be forced to slow or even reverse course? Perhaps because as we know, inflation? It can come in waves.

No matter, that’s a concern for another day. Just relax this weekend and chill. Like Johnny Kemp said . . . you just got paid . . . Friday night. Party hunting’, feeling’ right.

. . . or stay home, and go buy yourself something nice on Prime. You deserve it.

Please hit the “like” button and subscribe if you enjoyed reading the article, thank you.