Muttering About Oil Demand

February 18, 2022

Well that doesn’t look right.

We keep muttering to ourselves.

It’ll probably turn.

We keep muttering.

We’ll see I guess . . .

Mutter. Brow furrow.

It’s the only thing you can do when you see this.

This is implied demand, an indirect way of measuring how much oil products we are consuming in the US. 22.7M barrels per day apparently, an all time high this week. Okay maybe it’s an outlier for the week, a data blip. 4 wk average? 22.1M bpd, another all time high. So the figure isn’t a spike? Nope. It’s our baseline, >1M bpd higher than 2019 and it’s the dead of winter. Our consumption has never been higher.

What’s the reason though? Well obviously this is a factor.

As we anticipated, COVID cases in the US have plummeted and it’s time to get at it.

Let’s Go!

Get at what though? Apparently making and moving stuff.

The blue bars are “other oil” (i.e., the petrochemicals that goes into manufacturing, etc.). Although the chart is year-over-year, for both 2021 & 2022 we’ve reset the figures to compare both years to a more “normal” 2019 year. You can see for 2022, we’re notching much higher petrochemical demand vs. 2019 (the blue bars). Similarly, our demand for transportation fuels (black line) is higher as we’ve begun to commute back to work and travel for leisure.

Public ridership, however, is still depressed as the residual effects of COVID linger, forcing us into less fuel efficient modes of transportation. Some work-from-home policies are also likely impacting this data, so ridership should continue to improve as we move forward.

Nevertheless that delta exists, which means some of it will persist even if we return to working in the office. Some workers will simply opt to drive to work out of health and safety concerns. If a few million do that, then our consumption will be structurally higher moving forward.

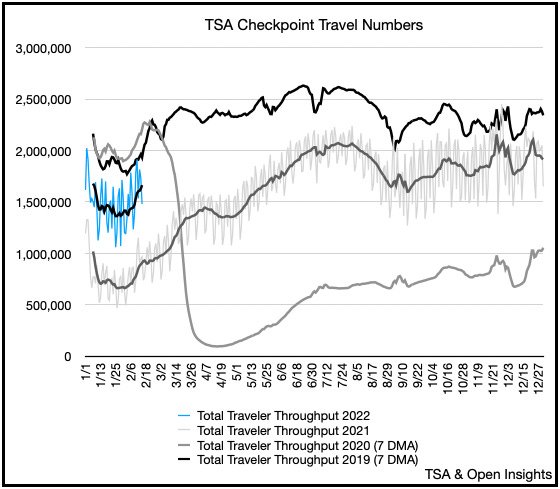

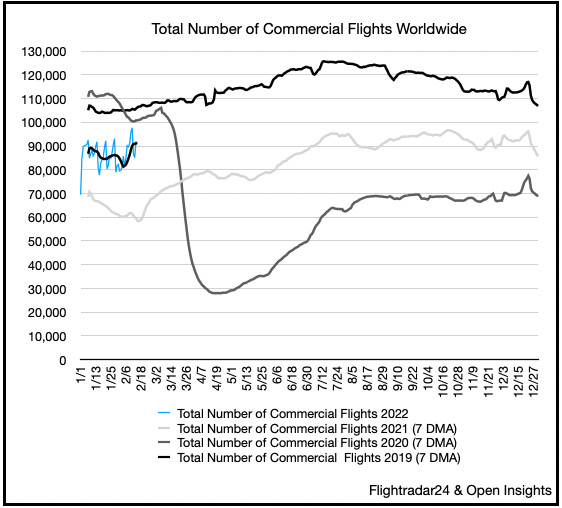

Adding to the commuting backdrop is the improvements in air travel. More passengers equal more flights today.

TSA check-ins are running only 14% below 2019 levels, the highest ever (including the holiday season in 2021). Commercial flights have also recovered to the same rate.

It’s not just people that are moving, goods are also moving quickly. Trucking demand is still exceedingly high as we continue to untangle our supply chains.

It’s set to continue because we’re still woefully short of “stuff” (i.e., inventories). Not just for our current levels of consumption, but even compared to our historic levels. We can see that as retail sales continues to outpace on the upside, inventories, while improving, are still short of what’s necessary. In turn, expect factories to run hard and those blue bars depicting petrochemical demand to stay high.

Don’t believe that? Try buying a car . . . if you can find one.

We did . . .

So overall, yeah we can see why consumption is up, why implied product demand is so high in the US. Then it occurs to us that this could also ricochet around the world as we reopen. Demand may simply go higher because of the same factors. Increased reluctance to take public transportation, higher interest in air travel, and the need to reengage our manufacturing base worldwide. We may be entering a period of higher energy consumption as we reawaken from our COVID slumber.

We’re off the Treadmill

We’ve addressed the supply short-fall affecting the oil market at length and won’t belabor the point here, but from the recent reports of Marathon, Devon Energy, Pioneer, etc., we can clearly see capital discipline holding in US shale. Just look at the smattering of companies here, which represent over 1M bopd/2M boepd of production (i.e., nearly 10% of US oil production).

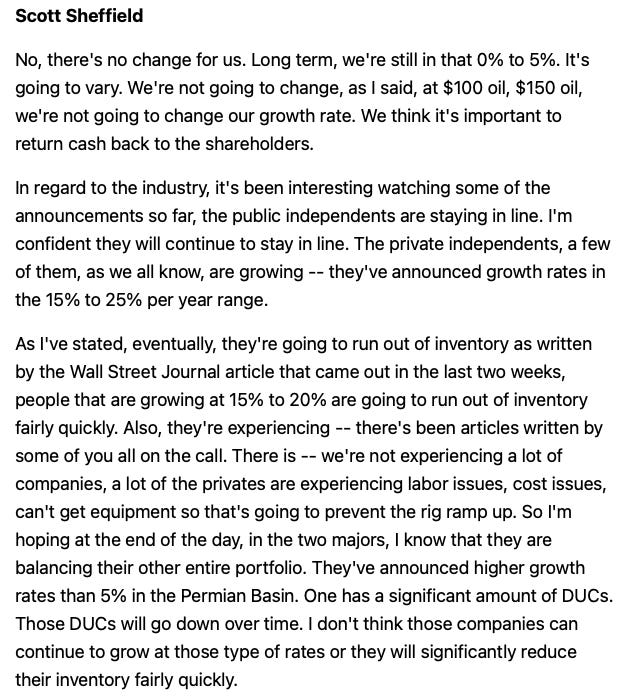

The only growth here will be free cash flows as reinvestment rates are kept in check. After years of underperformance and unsustainable reinvestments/production growth, many publicly traded US shale companies are declaring that they’ve stepped off the treadmill. Here’s an example from Pioneer Resources’ CEO Scott Sheffield (and some color commentary on private producers who represent a quarter of shale production in the US).

We anticipate as we get into the heart of E&P reporting season next week we’ll hear similar messaging. From DVN’s and PXD’s stock bounce in the past few days, it’s evident this is what the market wants to hear.

Internationally it’s a similar picture. Rig counts outside of OPEC+ have slowly recovered, but not in OPEC+ itself.

Which basically explains this picture (i.e., OPEC+ failing to keep up with its own self-adjusted treadmill).

Now Iran coming back to the fold should help, as it could arguably increase production by 500K bpd near term (and unwind ~70M barrels in floating storage). In a year, perhaps it can recover 1M bpd of additional production to reclaim the highs of yesteryear. We’re not entirely sure about that given the decay in field maintenance, but let’s assume that. If so, Iran essentially steps into the shoes of the US. What was lost in the US is now made whole . . . for this year. Fabulous.

Still that’s all supply. What about demand? What if global demand climbs beyond 2019 levels and mirrors the US? If US demand is already 1M bpd higher than 2019, and effectively negates the Iranian barrels coming to the market, what happens when the rest of the world recovers? What if global demand post-COVID exceeds 2019 levels, and the US is merely a big giant red, white, and blue canary in the calming?

Let’s be honest for a second.

We don’t have a scenario modeled for that because it would simply be an absurd figure. If that occurs, the projected draws we have on the board (which assume near-2019 levels) will simply blow out. We’ve already forecasted that oil prices will climb past $100/barrel this year and continue to trend upwards into 2023. If much of the world recovers from COVID (excluding China as their zero-tolerance COVID policies will set-up for some bumpy reopenings (see Hong Kong)), and demand exceeds 2019 in the reopened countries, then oil prices will go parabolic.

That’s crazy right? It’s delusional because we’ve all been fixated on supplies, who’s producing what and who can produce what. Yet, few are looking at the demand side, and if the US is a tell, reality may begin to sink in. Our voracious appetite may actually be getting stronger. We’ll know more in the coming months, but it’s something to monitor. For the last month and a half, however, we’ve apparently jumped off the global treadmill, and we’re hungry. Very very hungry.

We’ll see I guess . . .

As we mutter to ourselves.

Please hit the “like” button below if you enjoyed reading the article, thank you.

What if Saudi Arabia is already at peak production? Ditto for the UAE. Why would one say that? Look at historical production, irrespective of peak production. All of OPEC pushed out extra production from storage and opened their valves just prior to OPEC meetings when production quotas were assigned.

Also note the Saudi's oil inventories are running at about 2 decade lows.

Also, remember the age of Saudi oil fields. Many are 50-60 years old which is well past the prime age of 40 years. Two years ago, the Saudi's disclosed that Ghawar production was down nearly 2 million bpd from peak. That was 2 years ago. Depletion never sleeps.

The world is nearly out of spare capacity.

The parabolic oil move is right around the corner. The parabolic move will start in 2022.

What if Iranian barrels were already on the market. Some were sold to Iraq for distribution and the others shipped on boats with transponders turned off.