Our Q4 2023 Letter & Look Ahead

January 19, 2024

It’s an arcade claw machine. The baubles and toys call to us. It’s easy. Step-up to the joystick, insert your coins, and soon they’ll be yours. That joystick you’re holding? Yes, you have control. The plastic red ball says so. You have total and ultimate control over your destiny . . . or so you think. Slight tap there, smooth and deft fingers here. Some prefer a wide stance over the machine, with one hand on the controls and another on the glass. Others lean hunched over with only two fingers touching, better precision they say. The strategies may differ, but the goal’s the same, grab the treasure.

As the claw glides along its track quickly, confidence rises. Our hands control the action, so there’s a direct link between action and results. Review and apply our strategies, corner toy, or one in the middle? The one that we want seems to be buried, but there’s the other one that’s just sitting on top. Oh the choices! As if it mattered. Once made, the investors in us mash the “buy” button. With capital fully committed, the claw lowers. It lands on our prey and closes its jaws around our prize. In our mind it’s an alligator’s bite, an inescapable trap. As we prematurely celebrate our haul, something happens. Some unseen force of universal galactic energy intervenes like the hand of God to weaken the steel clamp. What had the tensile strength to crack a coconut suddenly weakens to a scalp massager.

What madness is this?! That flash of a thought is then followed by anguished screams, then silence when our prize falls away. A fall so complete that it mirrors our own physical and emotional collapse. We slump agains the machine, then rage against it. Look around and the Saudis are nodding in sympathy. We understand, they mouth. We’ve been trying our hand at this machine for years. We’ll tap it this way, nudge it that, and still our prize is illusive. A year and a half ago, we thought we had it, only to fall off at the end of the year. Aren’t you weary we ask? Yes, but necessity keeps us going. How else will we fund the modernization of our society? We both nod in commiseration.

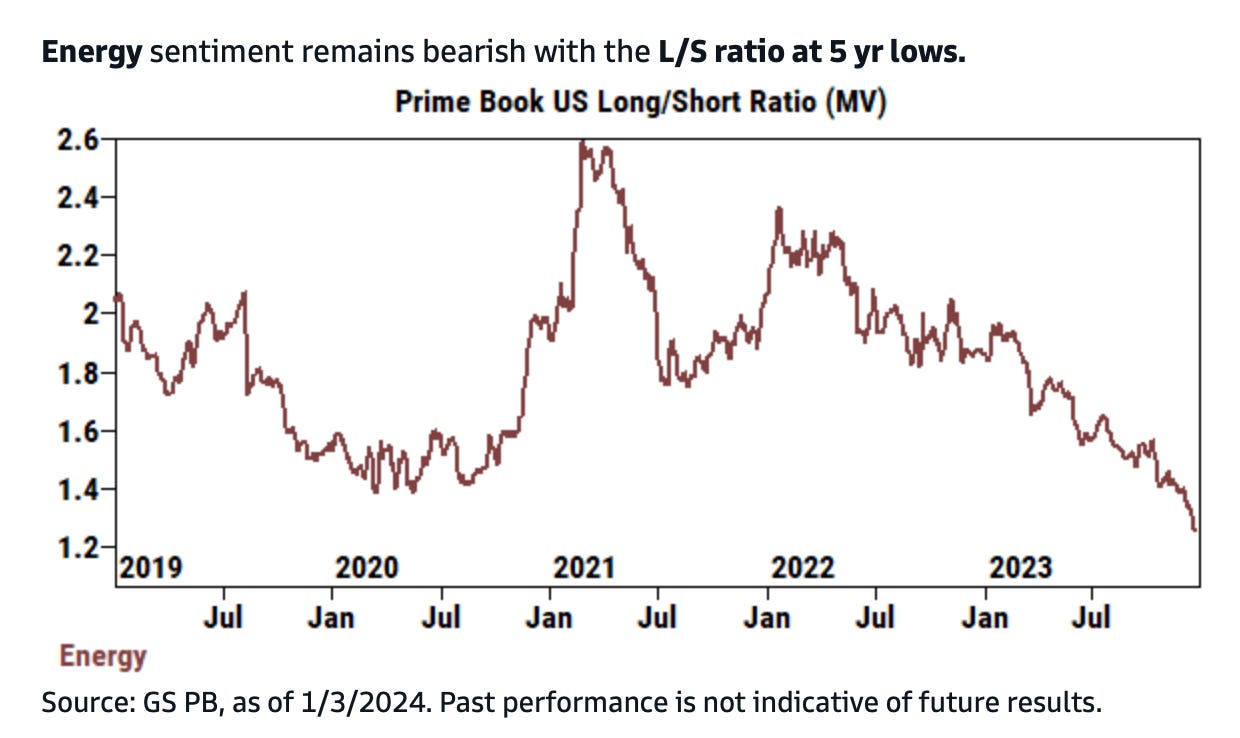

Some days though there seems to be no players in the arcade, no one looking and pining at the prizes. Like a Vegas casino floor though, people gravitate towards winners. We instinctually cozy-up to the craps table where everyone’s cheering. The disappointing cries from our corner just reaffirms the general perception that this sector is to be traded and not invested. It’s always something they tsk tsk. The machines are rigged, the players unskilled, and the volatility too great. The prizes aren’t worth having, and even if they are, they’re definitely worth less.

We stand at the machine wondering how this’ll all work. The markets are balanced right now, with strong supplies matching softening demand. Yet, how you achieve balance is often more important than actually accomplishing it. In 2022, we drained our strategic petroleum reserves (“SPR”). In 2023, we turned a blind eye to Iranian and Russian sanctions. All of these things come at a cost. Look no further than the near daily attacks on commercial shipping from Iranian proxies. Take a guess as to where Hezbollah, the Houthis, Hamas, etc. receive their funding. Politicians know that while voters revolt when gas prices climb, they’re agnostic when shipping costs rise. Despite all of this, the world absorbed the extra barrels, and we’re asking for more. Since 2020 we’ve discovered 1 new barrel for every 4 we’ve burned. Everything appears balanced, but with little institutional interest in energy and near zero geopolitical risk premium built in, prices are skewed to the upside. The world’s hold on energy prices is much more tenuous than it thinks. So we wait by the claw machine, because when they lose their grip, we’ll get ours.

Q4 2023 and 2024

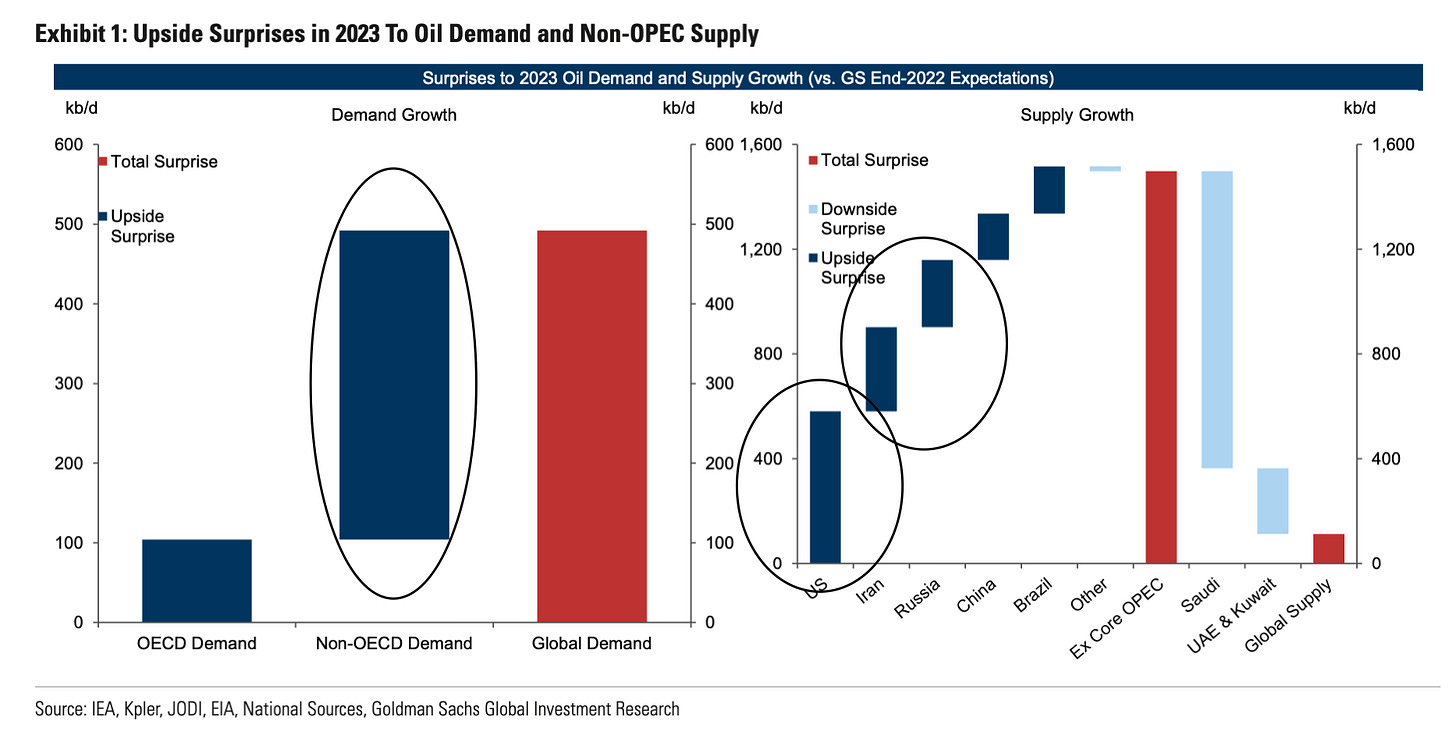

Fundamentals hardly justified the move in oil prices during the fourth quarter as oil prices fell by $20/barrel. Inventories were to a large extent flat. That though was problematic as many (including us) forecasted strong draws throughout the fourth quarter. When those failed to appear, the market quickly sold off. In the end, we saw a balanced and well supplied market for the quarter. Morgan Stanley called 2023 a market of two halves, and we largely agree. In totality, demand surprised to the upside last year. Despite calls for a recession, global GDP notched a healthy gain. By the end of the year, we do think the lag effects of quantitative tightening and higher interest rates began to be felt.

Economically, things did slow and demand softened in the fourth quarter. While demand didn’t crater, it certainly weakened, and what was a forecasted 1M bpd draw zeroed out. As we enter 2024, we believe demand will improve and likely surprise to the upside just as they did in 2023. Remember, analysts at the beginning of 2023 anticipated global oil demand to increase by 1.3M bpd, but oil demand came in above 2M bpd as post-COVID recovery coupled with general global growth spurred economic activity.

All of this begs the question that if oil demand surprised to the upside in 2023, shouldn’t we have seen inventories draw significantly more instead of stay flat? Well yes, but dig a bit and we can clearly see the other culprit, supplies.

Sur-pplies!

Contrary to what we anticipated, supplies also kept pace. How it kept pace with the higher demand raised our eyebrows. In order to balance the energy markets, the Western world effectively lifted all oil sanctions on Iran and Russia. Not technically of course, but any semblance of enforcement was jettisoned as the inflationary risks were deemed more unpalatable than the risks of Russian/Iranian destabilization. With oil prices having spiked in 2022, and Europe already mired in a recession after Russia cut natural gas supplies from the Nordstream pipeline, the West simply couldn’t afford triple digit oil prices. Just look at Germany’s deindustrialization post-Russia’s Ukrainian invasion.

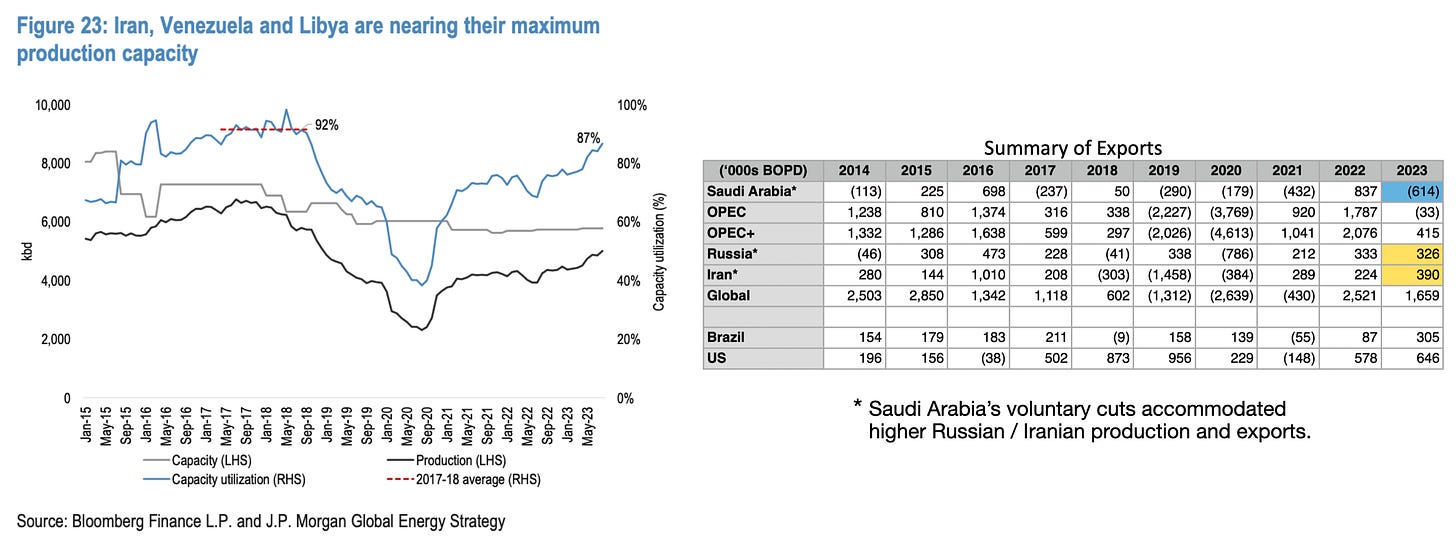

So tolerate a situation where oil prices again vault past triple digits? Nyet. Turn a blind eye to sanctions enforcement? Da. In fairness, it wasn’t like India and China was ever going to participate. Regardless, Russian and Iran were free to export to the market, so they did. Global seaborne exports increased by nearly 1.7M bpd, and Russia and Iran accounted for almost 700K bpd of that amount (Kpler).

Both of those figures are understated because Russia and Iran maintain shadow fleets of ships that turn their tracking transponders off. The real figures are likely 500K bpd higher in total. Nonetheless, from what we can see, we see more. To “accommodate” the increased Iranian and Russian production/exports, Saudi Arabia has been forced to enact voluntary cuts to balance the market. Exports from producers is what matters. So overall, higher Russian and Iranian crude exports were offset by lower Saudi Arabian ones. Net/net, OPEC+’s exports were only higher by about 400K bpd. So who else exported more? Brazil and the US.

US production certainly surprised to the upside. We’ve been writing for a few quarters that US production growth should start to slow and begin stagnating, but that has yet to occur for a host of reasons: private producers ramped production to window dress for a wave of M&A, European energy firms increased production in the Gulf of Mexico after their ESG projects proved mediocre, and in general, US production grew in the prolific Permian basin. The first two of these things are temporary, and once consolidation occurs, public oil companies will impose discipline to wring out cash flows from the assets. S&P Global Commodity Insights estimates that nine (previously) private companies have accounted for more than all the growth in US lower 48 crude production between December 2019 and April 2023. In 2023, Civitas agreed to acquire two of those companies, and Occidental, one of our core holdings, agreed to acquire CrownRock. So as we shift operational control of the prolific acreages from private to public companies, production growth will slow. Furthermore, the increase from the Gulf of Mexico will remain, but the velocity of growth will slow after the initial increase. Hence these one-off tailwinds will fade.

Truthfully, if we’re ever to be right about our oil scarcity thesis, US production growth needs to moderate. If the gains in US production persists (i.e., if we’re forced to contend with 1.5M bpd of increases year-over-year, every year) this thesis is frankly unviable. From what we’re seeing, however, the growth of US production is poised to slow and the recent surge will taper. While we fully expect US production to grow, what matters is the velocity, what was a ~1.5M bpd increase (2022 average to 2023 average for crude and condensate), should decline to ~500K bpd in 2024.

There’s simply a lag between what we’re seeing and what we think production will do. It’s critical what US production does here in Q1. If we’re correct, US production will decline in Q1 and then growth will level off for 2024. The lag between oil rig counts dropping off and production slowing is typically 12 months, and if that historical pattern holds we should see those impacts soon as there are 20% less rigs drilling today than a year ago, flat spread counts (i.e., crews that complete the wells), and certainly less drilled and uncompleted wells.

Check that. We’ll need to see those impacts soon. If global demand increases by 1.3M bpd as forecasted, and US production increases the same 1.5M bpd as 2023, then inventories will rise and prices will fall. Yet, again, we are optimistic on this front as recent data has pointed to a stall in the production growth.

So where does this all leave us? Well standing shoulder-to-shoulder with the Saudis at the claw machine.

Just step-back and think about what we’ve done for the past 1.5 years. The oil market has fully absorbed the return of Iranian oil to the market, Russian’s relentless growth to fund their Ukrainian war, the unprecedented release of global strategic reserves, and the US’s surprise increase in production in 2023.

The outlier risks to this market was always Iranian and Venezuelan barrels coming back into the market. If so, the market would need to adjust, and other producers would need to cut production/exports to accommodate the barrels otherwise inventories would balloon. Who stepped aside this year? The Saudis.

As Iranian and Russian production nears their max, who’s left to fill the gas if demand surprises to the upside? Again, the Saudis. They, along with Kuwait and UAE, possess the material remaining amount of spare capacity. Leverage swings the other way and as the self-described central banker of oil becomes the last “go to” source for incremental barrels. Three countries, the US, Canada, and Brazil will satisfy a large portion of demand growth this year, but if demand surprises higher and/or supplies disappoint, the market will be forced to turn to the Saudis. This becomes increasingly true in the coming years with reserves drained, forcing consumers to turn to sanctioned barrels. If you doubt demand can outpace expectations for a third year, we won’t quibble, but we don’t agree.

For 2024, IEA anticipates total oil demand will grow from 101.7M bpd to 103.0M bpd, an increase of 1.3M bpd, and much of that increase will come from China, which is expected to grow by 800K bpd. Is that logical when China grew by 1.7M bpd in 2023 and still saw soft economic data? We believe that the Chinese recovery that we anticipated in 2023 has simply been deferred to 2024, and demand should rise to the upside as the property market bottoms and authorities begin to stimulate in earnest post-Chinese New Year (February 10). China need not rebound dramatically, arresting the downward spiral and boosting consumer sentiment will translate to higher demand, and in turn, boost the economic prospects of other Asian countries and Germany (one of it’s largest trading partners and a key to aid the EU’s revival).

As for rates, we’re entering a period where the Fed and ECB are arguably too restrictive in their monetary policies. We have inflation ranging from 2-3% (depending on whether you’re looking at the PPI or CPI), and fed funds rates at 5.3% or the proxy funds rate (a composite of what rates “feel like”) at 6.3%. So there’s room to cut to achieve neutrality. Thus, a reduction of interest rates and softer inflation figures vs. 2023 should reduce the stress on the economy. Rate reductions will also help the heavy industrial and more capital intensive industries such as construction. While it won’t usher a building boom, a bottoming, or simply less economic drag equates to higher demand and energy consumption.

Lastly, there’s still a gap. There’s still a gap between the pre-COVID trend-line and post-COVID one, and as certain as we were that activity would return, we’re also certain demand to close that gap will appear. Year-by-year, little-by-little.

We were so desperate to keep oil prices steady (between $70-90/barrel) that we’ve essentially lifted all Iranian and Russian sanctions. Fair enough, but that tradeoff hasn’t been costless, instead of higher oil prices, we’ll pay for higher transportation costs as tankers and shippers avoid the Middle East and redirect from the Suez Canal to the tip of South Africa. Houthi, Hezbollah, Hamas, Iraqi Shia militias, the Taliban, etc., take your pick, the list of Iranian proxies destabilizing the regions is extensive, and funded in large part by Iranian oil revenue. So yes, you might be saving a nickel on gas, but you’re certainly going to pay for it rerouting cargo and tanker vessels, shooting down $20K drones with million dollar missiles, and maintaining large military forces in an unstable region. There are no free lunches.

Parting Thoughts

We’ve held this oil thesis for quite awhile and we certainly understand the give and take of risk/reward and what’s possible and what’s bunk. We’ve survived ESG, Saudi oil price war, COVID and geopolitical fades, we’ve survived Russian and Iranian crude being reintroduced into the system, and up to this year we’ve largely kept pace with our benchmark despite investing in one of the most hated sectors in the market. Sentiment at this stage is so low that we are near COVID levels for non-commercial crude positioning (chart per Giovanni Staunovo). Note that this is the paper market, those 30 barrels of paper oil being traded and exchanged as opposed to the 1 physical barrel actually used.

It’s noteworthy because sentiment is as bad today as it was when we globally shut-down. The difference at today’s nadir? Oil prices are still $70/barrel. The scarring on the sector runs deep though. Burned fund managers find it much easier, less controversial, and less volatile to invest in anything but energy.

Makes sense, but go ahead. Go ahead and shift the leverage to the Saudis, UAE, Kuwait, the Middle East. Run things everywhere hot and lift sanctions on destabilizing actors in the region. We reiterate, there are no free lunches, and this one will cost us in different ways. Eventually, it will cost us at the pump. Perhaps not today, but it will all come together, something my son recently reminded me of.

After averaging 2-4 points in his basketball games, my nine year old scored 16, 8 and 12 in three games this past weekend. Surprised, I asked him what changed:

Me: Bubba, you were so good this weekend, but what were you thinking on the court to make that happen?

Mason: I don’t know, I was just playing . . .

Me: It must be something because you were a totally different player.

Mason: I just kept thinking . . . make basketball happen.

Me: Huh?

Mason: You know, attack, score . . . pass, I just have to make things happen on the court.

Me: That’s deep for a little guy.

That nine year old’s self-revelation in basketball only comes after grinding for awhile. It’s when all the skills you’ve been practicing quietly all comes together, with no obvious catalyst. Jeff Bezos once said “[Y]ou can be grinding for 4 years with no results, and in the 5th year, become the biggest thing on the planet. The power of not giving up is real.”That mentality often never applies to investing and finance because this is a relative market. How you perform against your benchmark, your peers, your competitors, matter. Though we’ve held our own through a mix of skill, luck, prescience, solid companies, and yes, Warren Buffett, the world’s energy supplies are increasingly precarious and in the hands of producers unfriendly to Western interests. If anything the rising risks means energy prices should be higher than where they stand today, but no matter, they will reprice when they reprice. Just bring your lunch money when they do.

Please hit the “like” button above if you enjoyed reading the article, thank you.

I love all your posts, but this one may be my favorite. Cheers! 😀

Outstanding analysis. Spot on.