The Market's Soaring on the 4th of July

July 5, 2024

Happy 4th of July weekend everyone. We’re probably writing to crickets about now, but that’s fine. Since we’re all busy bar-b-queing this or that, we’ll just plaster a few charts here for your viewing pleasure.

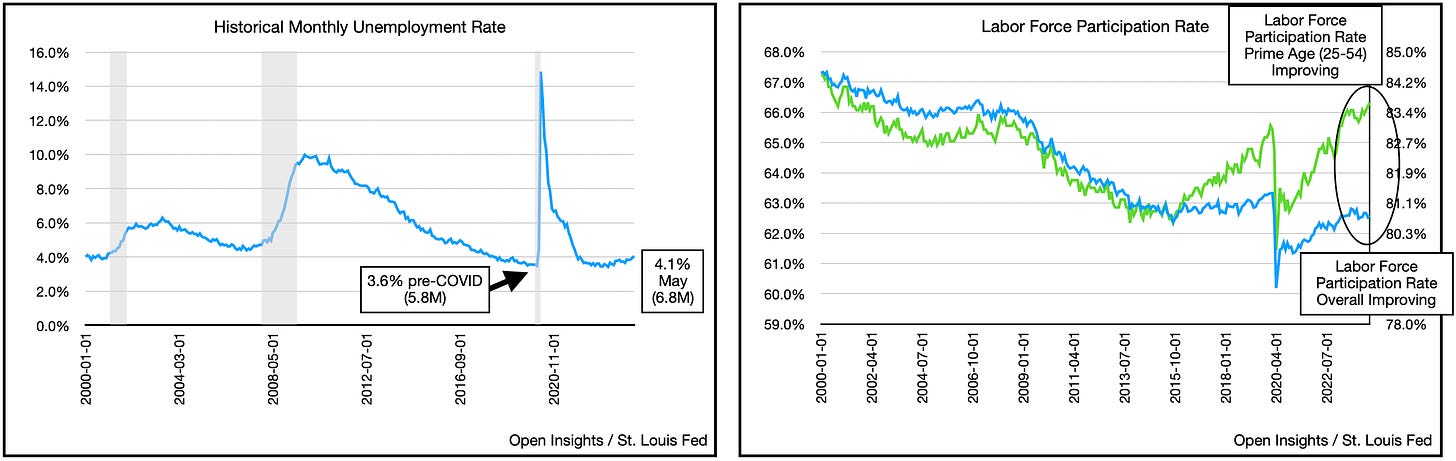

Friday’s big item was an employment data drop. The unemployment rate climbed higher to 4.1%, triggering a market rally on the expectation that a weaker labor market will allow the Fed to cut interest rates beginning in September. So what’s bad (i.e., increasing unemployment) is being read as good (i.e., allowing rate cuts).

Fair enough, just don’t expect it to come without pain as unemployment creeps up here.

This is, however, where things also get touchy. The labor market can quickly deteriorate, and a soft weakness can tumble towards a hard landing if confidence deteriorates uncontrollably.

Under the labor hood, real-time indicators have fallen further.

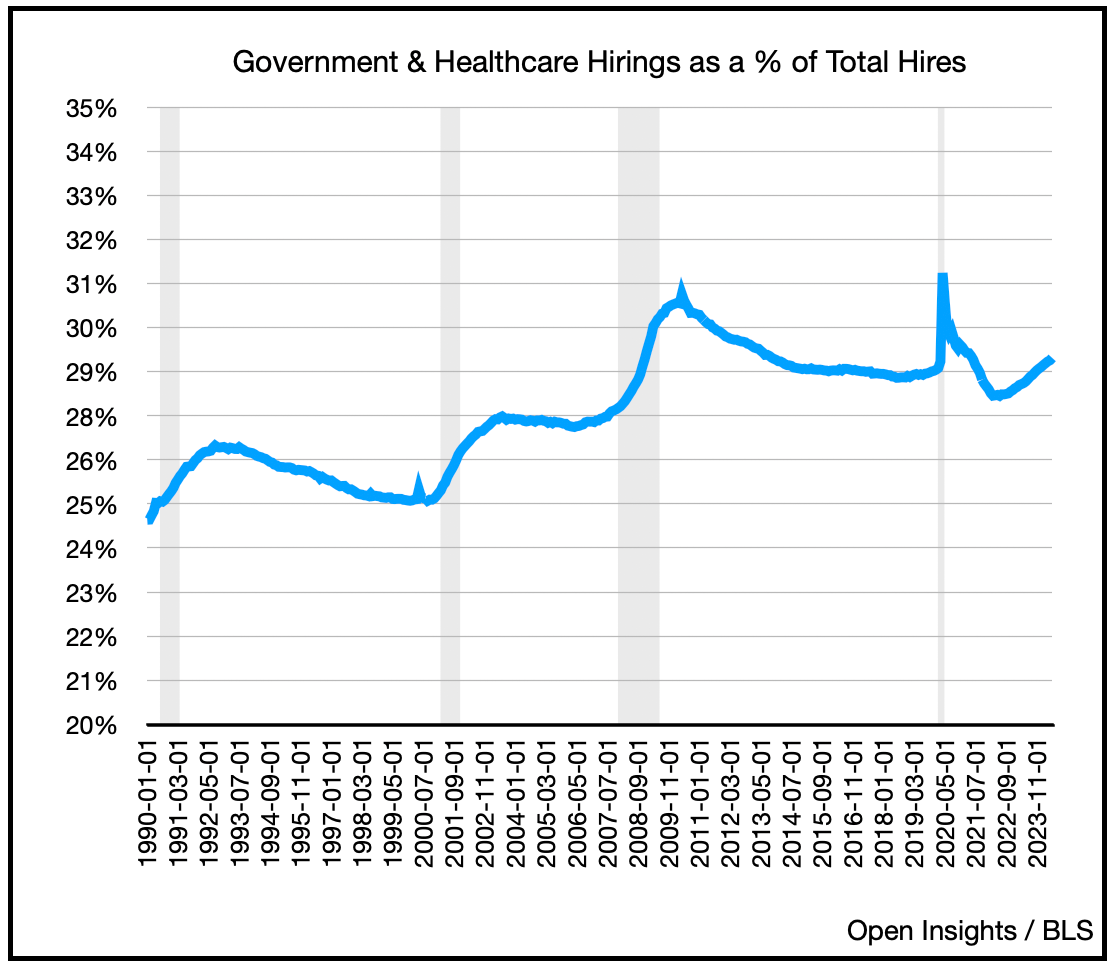

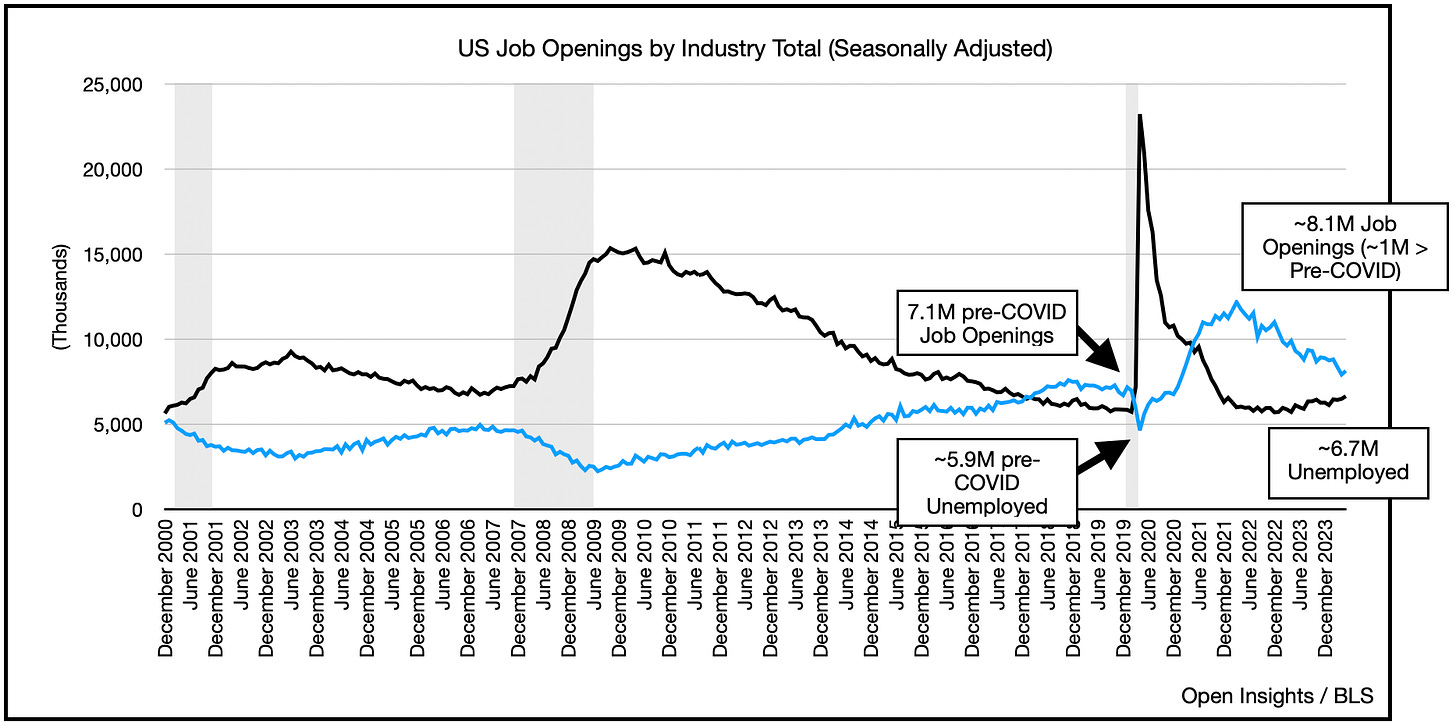

Job listings are softening while temp help is declining. Moreover, most of the hiring is in the healthcare and government sectors.

Some analysts have poo-poo’d that, claiming that government support is what’s keeping the labor market afloat, but we don’t think that’s dispositive. Government and healthcare tends to historically employ ~27-29% of total employed (and it continues to be within that range even with the recent hiring).

Still at 60-75% of total monthly hirings lately, it is on the slightly higher range.

So really, things are weakening, and we’re close to “pre-pandemic levels” for job openings vs. the number of unemployed.

As we dip below, the key question is how far below. That my friends will tell you how hard this landing could be.

In contrast, the markets sure don’t seem like they’re going to see a landing anytime soon.

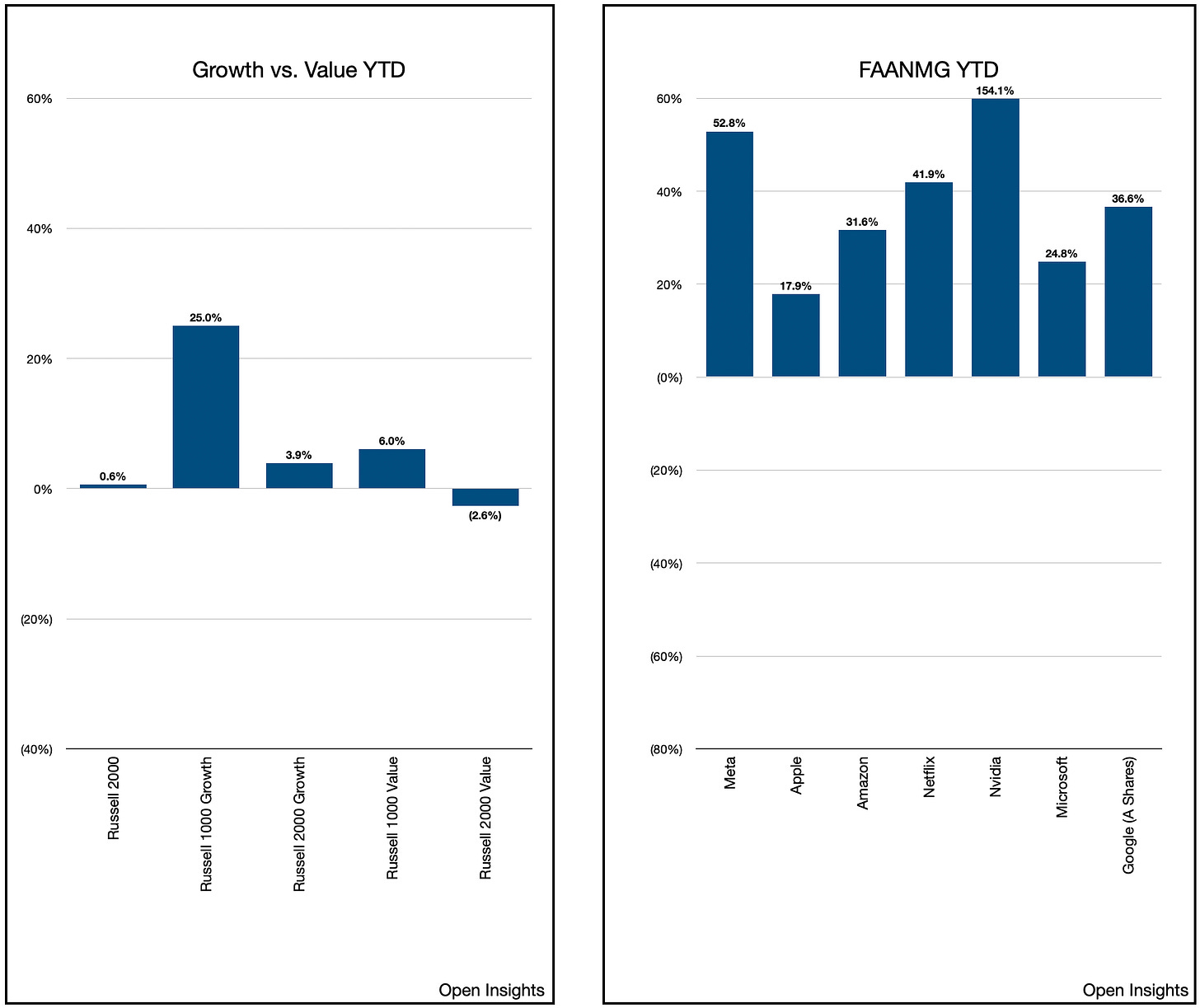

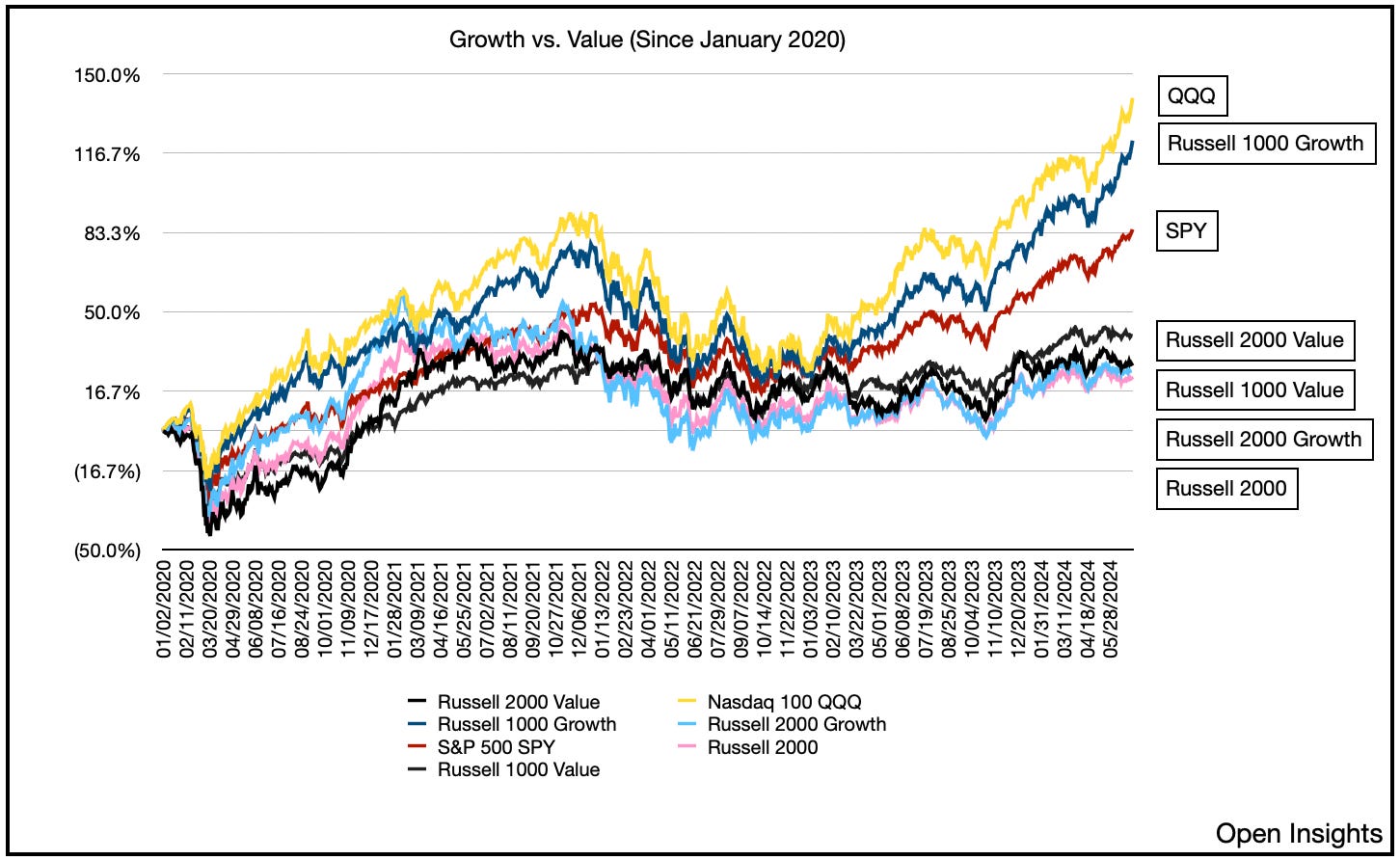

Rates are likely going down, and the market’s already pricing that in. Falling rates = easing gravity, and easing gravity = asset prices rising, especially for tech in general. It’s why tech stocks are bounding, but everything else is lagging.

Everything else is “the real economy.” I mean, just look at this outperformance, one dominated by Big Tech. Whether, it’s Russell 2000 small cap stocks, or even large cap stocks (not named FAANMG), there’s just a gaping divergence.

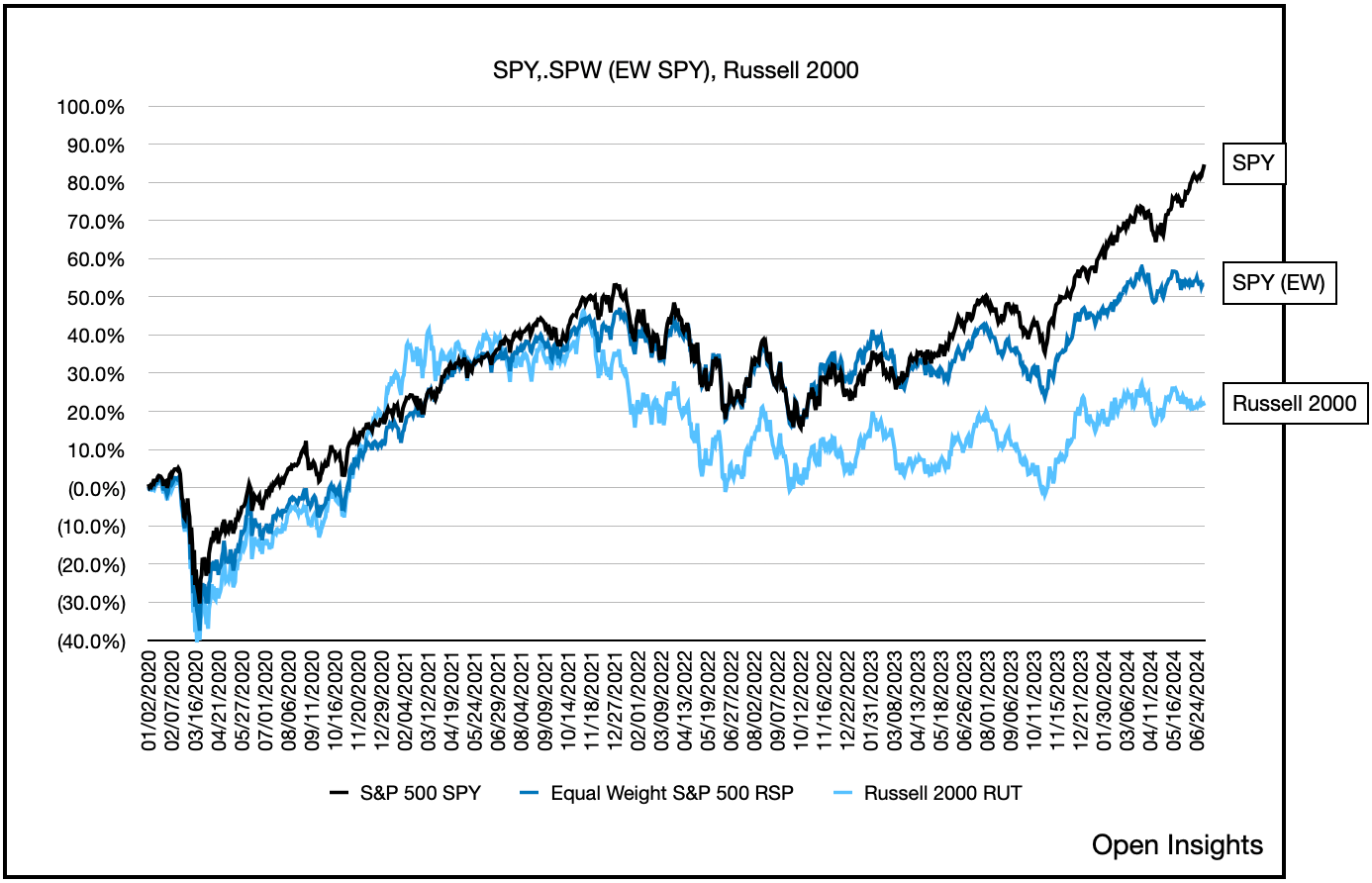

Forget market cap weighting, equal weight the S&P 500 and you can tell, the S&P 493 (i.e., not the Magnificent 7) are completely ignored.

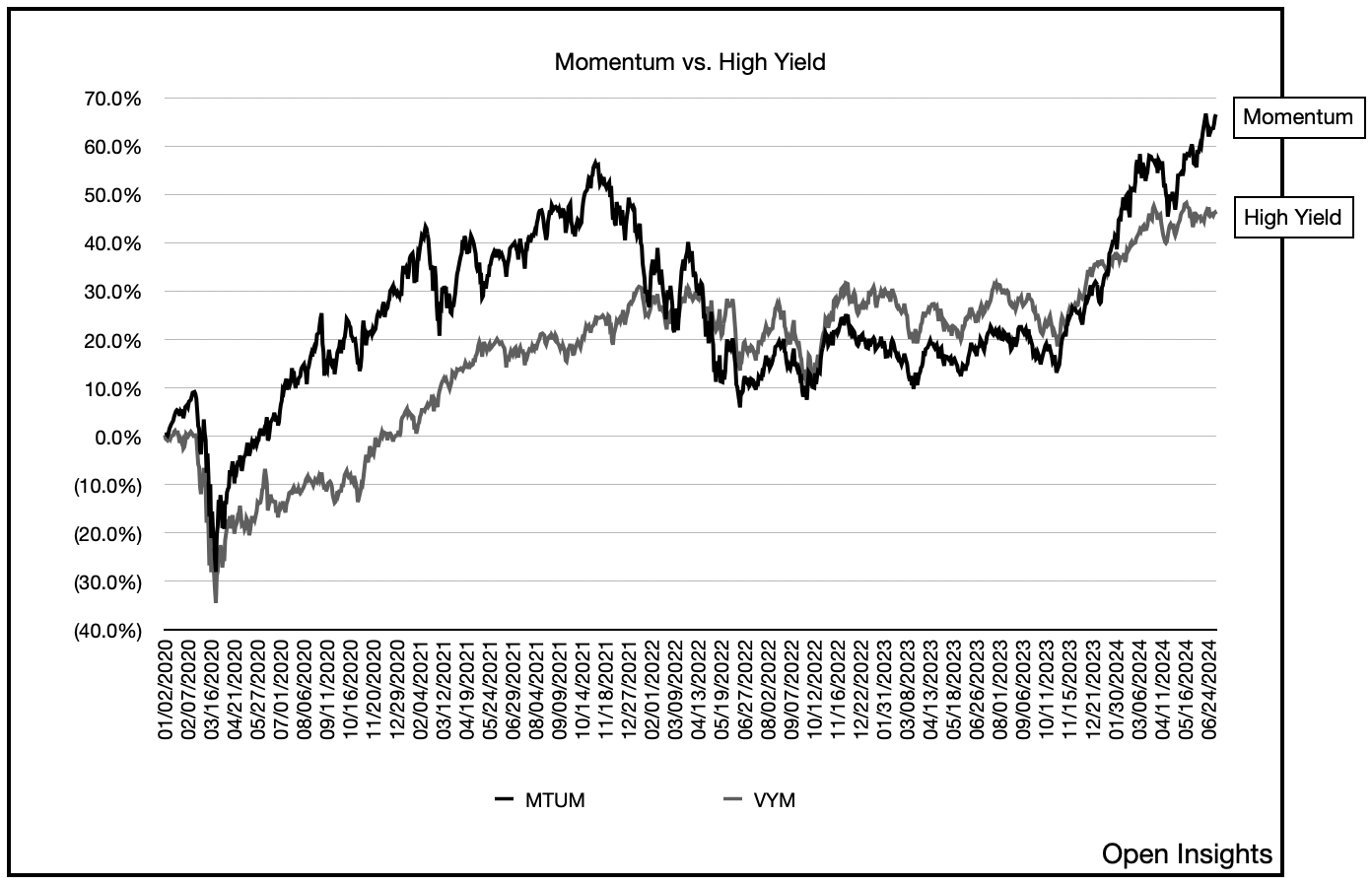

Thanks to those Mag 7s, QQQ (i.e., the Nasdaq 100) simply trounces, and as it takes the lion’s share of gains, the momentum algo funds jump in while the water’s warm.

For stock markets that are at all-time highs, spurred largely by Big Tech’s ferocious gains the in the past few months, this is a great short-term set-up, but as we get further stretched, we’re getting euphoric.

No matter though. It’s a holiday weekend, and we’re celebrating. Stocks are mooning, and rates are falling thanks to a slowing economy. That’s a good thing right?

Right? . . . Eh who cares . . . grab a beer, and a flag.

Happy Birthday you big beautiful country.

Happy Birthday America!

Please hit the “like” button below if you enjoyed reading the article, thank you.

Thanks for the charts and thoughts! I have a slightly different take on the government and healthcare hiring as a percentage of the total. Seems that outside of a recession (or coming out of one) you would not expect to see the inflection higher that is being seen now. Points towards the growing impact of demographics and fiscal dominance imo.