What Happens When Consumers Stop Buying A Latte?

May 3, 2024

I remember very few things from my first year of law school. In time, all trauma fades I suppose. I jest, but it’s not far from the truth. My memory’s hazy because it’s been awhile since I last sat in those classes, and even when I did, they seemed like a blur. New city, new friends, new environment. Most importantly, the first few months of law school is about getting comfortable with a whole new language, and a new way of thinking.

Personal property is no longer “stuff,” but chattel, and consideration isn’t merely being polite, it’s something of value to be bargained or exchange for.

You get the point. I’m sure doctors-in-training, or any new professional experiences it. These are all worlds unto themselves. You get used to it though. Hopefully by your second semester you start to get the hang of it . . . or you better because you’re about to start interviewing for a job. You know, the thing that could/may/will pay for that fancy diploma you’re striving for. If you don’t? Well let’s just say you may be in arrears on those loans post-graduation, as the world kicks you in your arrears.

So what DO I remember? Well two things come to mind. First . . . Palsgraf. Now Palsgraf is a pretty famous case. Any 1L will know it. Long and short, in Palsgraf v. Long Island Railroad, Ms. Helen Palsgraf was waiting at the rail road station in 1924 waiting to take her kids to the beach. Further down the platform, two gents (since we’re being “old timey”) rushed to board a different train, but as railroad employees pushed and pulled them onboard, one of the fellas dropped a box of fireworks that exploded. The explosion caused a scale further down the platform to fall, which hit Ms. Palsgraf on the head, and sadly, caused some brain injuries from which she never fully recovered from. Ms. Palsgraf sued claiming that the employees had been negligent while assisting the man who boarded ahead of her, and that the negligence caused her harm. She won in the lower court, but was subsequently bonked again when the Appeals Court struck down the victory by ruling that the railroad didn’t owe her a duty of care. Just because there’s “negligence in the air, so to speak, will not do.” Discussions about proximate cause ensues, and the youngling lawyers all get to gnaw on the Palsgraf gristle.

The second thing I remember in Torts class was the professor professorially saying (and of course I’m paraphrasing) that good lawyers tend to see the law in black and white, but better ones see the world in shades of grey. For whatever reason this observation stuck with me. Well before 50 Shades of Grey, it was a passing comment, but captivating nonetheless. Even today, many years later, I remember it because as investors, we rarely see things black and white. Raise any topic and we’ll almost always hem and haw a bit about this or that. Even if we’re certain, we’ll probability adjust it because . . . well “stuff” happens. We’ll end conversations with “we’ll see” or “it is what it is,” meaningless verbal ticks that only convey the certainty of our uncertainty.

We’ve described investing as pointillism painting with money. Whether it’s the Fed’s dot plots, or any itinerant economic indicator, you’re coloring in dots that hopefully and collectively provide a coherent picture. So why the stroll down memory lane? Why bring up Helen and her battle with the scales of justice and the uncertainty of it all? Well, we’ve recently been wondering . . . are we Palsgraf?

Remember this is a lady standing on a station platform, looking forward to a sunny day on the beach with her kids. Then someone drops a box of fireworks over there, and bonk, she gets whacked on her head. Who would’ve . . . *thunk?*

. . . too soon for jokes.

Just a week ago, we wrote this about the American consumer.

An Ode to the Dog in You. The US Consumer.

I recently saw a tweet by @AIsafetymemes, who kept asked ChatGPT to make a dog . . . and then make it happier, and happier . . . and happier . . . and thought, you know, this is basically the American consumer. So here goes: YOU . . . you . . . are an absolute animal.

It’s still true, because we are after all doing pretty well, but has someone further down the train platform already dropped a box of low grade boom sticks that’ll set in motion a series of events that eventually whacks us?

Could it be just on the lower end? Hmmm nope . . .

“Across all regions, Starbucks reported shrinking same-store sales and falling traffic. In the U.S., same-store sales decreased 3% as traffic sank 7%. This marks the second quarter that the company’s home market has struggled.”

“In this environment, many customers have been more exacting about where and how they choose to spend their money,” Narasimhan told analysts on the company’s conference call.

That’s Starbucks . . . what about this fella? On the lower end, we’re also seeing this guy stumble . . .

“It is clear that broad-based consumer pressures persist around the world,” McDonald’s CEO Chris Kempczinski said on the fast-food chain’s earnings call early Tuesday. “Consumers continue to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending.”

From the McDonald’s Q1 conference call, we can see the headwinds gathering . . .

“As you know, we talked about 2024 being a year where we felt top line was going to moderate. I think four months into the year, I think what we can say is, clearly, 2024 isn't going to be a typical year for the broader industry. I say that because we're certainly seeing, as you heard in our upfront remarks that the macro headwinds have been more significant than I think we even anticipated coming into the year, and we continue to see those macro headwinds as we have started quarter two. And frankly, many of our large international markets and the U.S. And I think we expect in the U.S. that we're going to start the quarter roughly flat from a comp sales perspective from what we can see so far.”

“And I think affordability is clearly an area where consumer expectations are heightened. I mean I think consumers are obviously dealing with a lot in the current macro context. Obviously, they're getting hit.”

Starbucks and McDonalds are bellwethers on the high and low-end. Not everyone can afford a $6 latte, but everyone can afford a Big Mac. People’s drinking and eating habits are also sticky. If your routine is a morning coffee and/or an afternoon Frappacino, then you tend to stick with it. It’s a sugar/caffeine addiction, and those mental and biological addictions are hard to kick. Moreover, if you enjoy a weekly Big Mac with fries, then skipping a week probably makes the world a bit gloomier.

As inflation surges, maybe you don’t always Supersize those fries, maybe you just go with the Tall drink (i.e., a Starbucks small drink) instead of a Grande (i.e., medium). That’s the first step. When the consumer starts to cut back, the average ticket per customer starts to fall. Bad as that is, at least there’s still a ticket. What happens when traffic (i.e., customer visits) to your store falls? That’s when things get real as economic pressures force a change in habits. People stop visiting . . . they in legal parlance . . . forbear.

Remember, people rarely change their behaviors. Unless it’s money or life, people will generally keep doing what they’re doing until they can’t. Smokers smoke, gamblers gamble, and degenerates degenerate. So when same store traffic starts to slide, we pay attention.

It’s not that things are falling apart right now. Far from it. If anything, things appear to be slowing down for the consumer. It’s not just a pull-back on food and beverage, but even some of the more discretionary types of items . . . from $100 leggings . . .

to $10 eye liners . . .

Maybe the consumer is starting to feel some stress.

As inflation holds steady here around 3-4% (nearer 4% we think), wage growth will have to keep pace. Thus far, it’s done that, though the days of healthy gains are starting to give way as wage increases slow, but higher inflation persists. Hence “real” wage growth is trending lower.

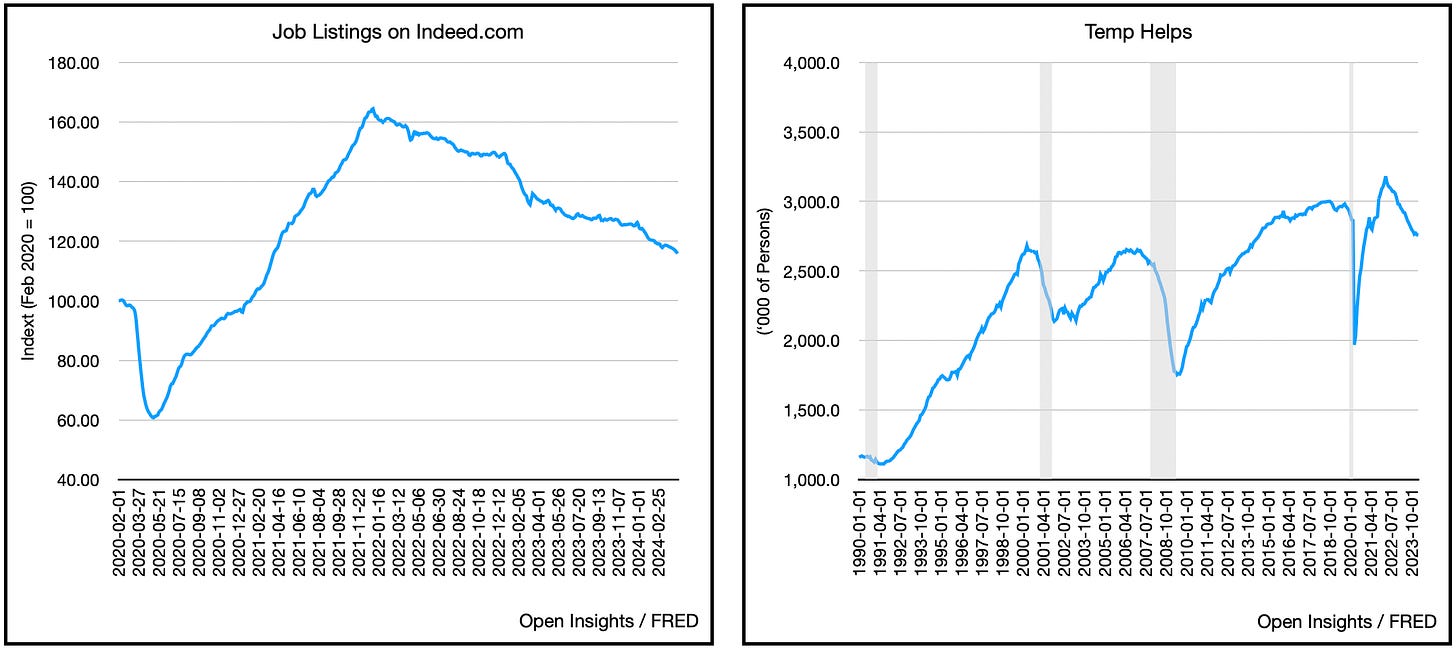

Job openings are similarly normalizing after the post-COVID increases. Whereas before it was exceedingly tight, it’s less so today.

As the heat’s turned lower in the job market, the need for temporary workers has also declined.

Ultimately, job openings and the availability of workers combine to drive wage increases, and slowing momentum on those fronts will inevitably lead to lower wage growth.

Now we didn’t “time shift” the two charts above, but if we did, those light blue lines (job openings and job quits) lead the dark blue line (wages), and it’s portending for smaller raises in the future.

Certainly the dozen data points above don’t paint a full picture. Each of them have distinct idiosyncratic factors that are serving up their own challenges for their stakeholders. For McDonald’s maybe it’s the menu selection, for Starbucks it could be some ill-conceived price increases or over-expansion/market saturation. Still, on the whole, some common themes are emerging.

Consumers are feeling the pressure, and when behavior begins to change, our attention needs to perk-up. Again consumer consumption drives over 2/3rds of our economy, and when asset prices are near their highs, the impact of good “but just slightly not as good before” can ripple and cause some unintended consequences and fireworks in the market.

So best pay attention no matter where you are, even on sunny days waiting to go to the beach.

. . . just ask Palgraf.

Please hit the “like” button above if you enjoyed reading the article, thank you.

Very well written here. timely and perceptive I believe