Quad City Here We Come: Stagflation & Oil

March 21, 2025

Anyone remember this song?

Quad City DJs’ C’mon N’ Ride It (The Train)?

Released in 1996, it’s the quintessential Jock Jam, and ranked by Rolling Stone as one of the top 200 Greatest Dance Songs of All Time. Choo choo!

I smile as I type this, since it hilariously brings back memories of cringeworthy and yet delightfully simpler times. Sill this song popped into my head not because of nostalgia, but the group’s name. Quad City DJs.

Who or what’s spurring that thought? Well . . . this guy.

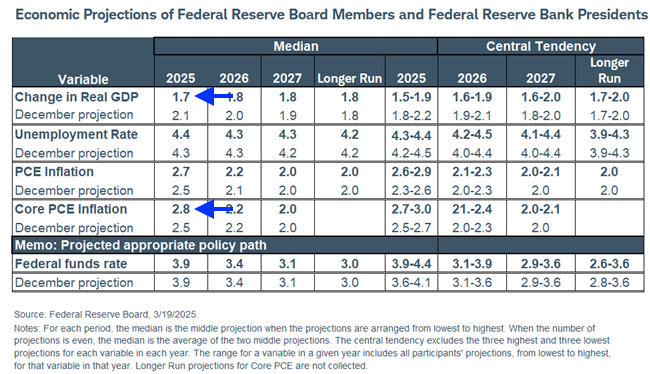

Jerome Powell. Who knew The Fed Chair was part of the group?? We say this because as you may know, the Fed guy delivered remarks following the FOMC meeting on Wednesday, and as widely expected, they kept interest rates steady. More importantly though, the Fed downgraded its forecast for US growth from 2.1% to 1.7%, but simulataneously hiked their inflation outlook from 2.5% to 2.8%.

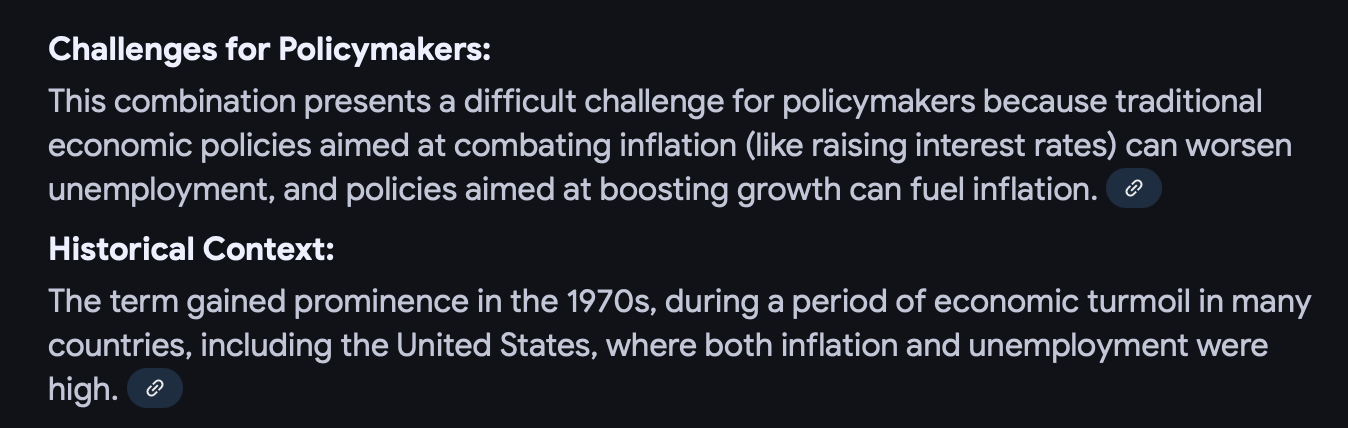

What’s this mean? Well couple slowing economic growth with higher prices, and we my friends have stagflation. We’ll let our AI overlords define it.

“Stagflation is an economic condition characterized by high inflation, slow economic growth, and high unemployment happening simultaneously.”

That’s right . . . the 70s. We don’t anticipate inflation to be anywhere near as high, but as we’ve previously written, they will continue to stay higher than the 2% target the Fed’s pursuing, simply because wage increases will keep labor costs up. Hammer that with the push to tighten immigration, and you have the ingredients for a tighter labor market. Tariffs (i.e., taxes), are also increasing as the Trump administration continues its policy pushes: redomestication of manufacturing, boost US competitiveness (i.e., deregulate, tax cuts, and rate cuts), deflate the value of the US dollar, and reduce US security obligations on the global stage.

For a country that continues to import a significant amount of its goods, the tariffs and US dollar devaluation will naturally drive up the inflationary pressures companies and consumers face.

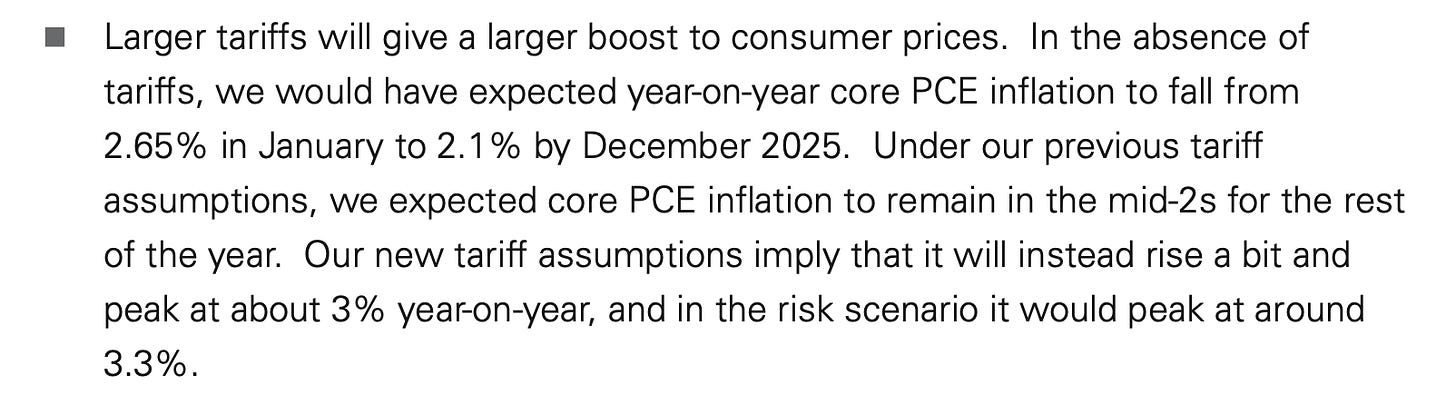

In 2022, US imports of goods and services amounted to ~16% of GDP, of which ~11% are imported goods. Slap an average of 10% tariffs and you’re looking at a 1% increase in inflationary pressures on goods alone. Let’s go further down the rabbit hole. What if you slap China with a 60% tariff? Well of that ~11% of imported goods, China accounts for ~17%, so give or take 1.8% GDP * 60%, so you’re looking at 1% increase in inflation on that portion alone. If inflation is running at around 2.8% (latest CPI print) before the bulk of tariffs are implemented, then it makes sense that a 3-3.5% inflationary environment going forward might make sense? It’s rough math, but that’s what Wall Street’s thinking.

To double-check, let’s see what the economists at Goldman Sachs have to say on tariffs and inflation . . .

What about GDP?

Yup, it pencils out.

So armed with this forecast, Wall Street inevitably plugs it into their models. What does one do in a “stagflationary” environment?

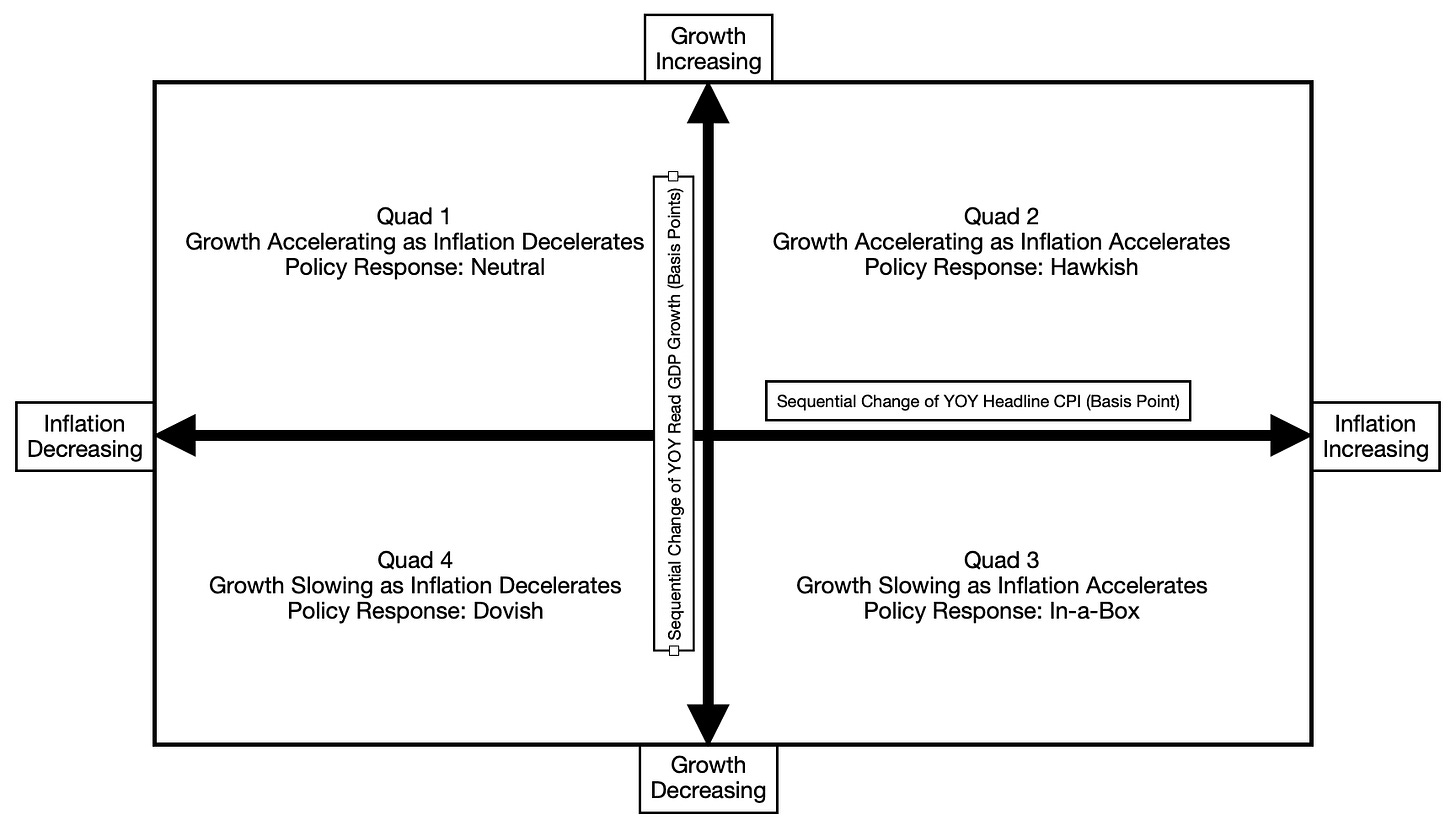

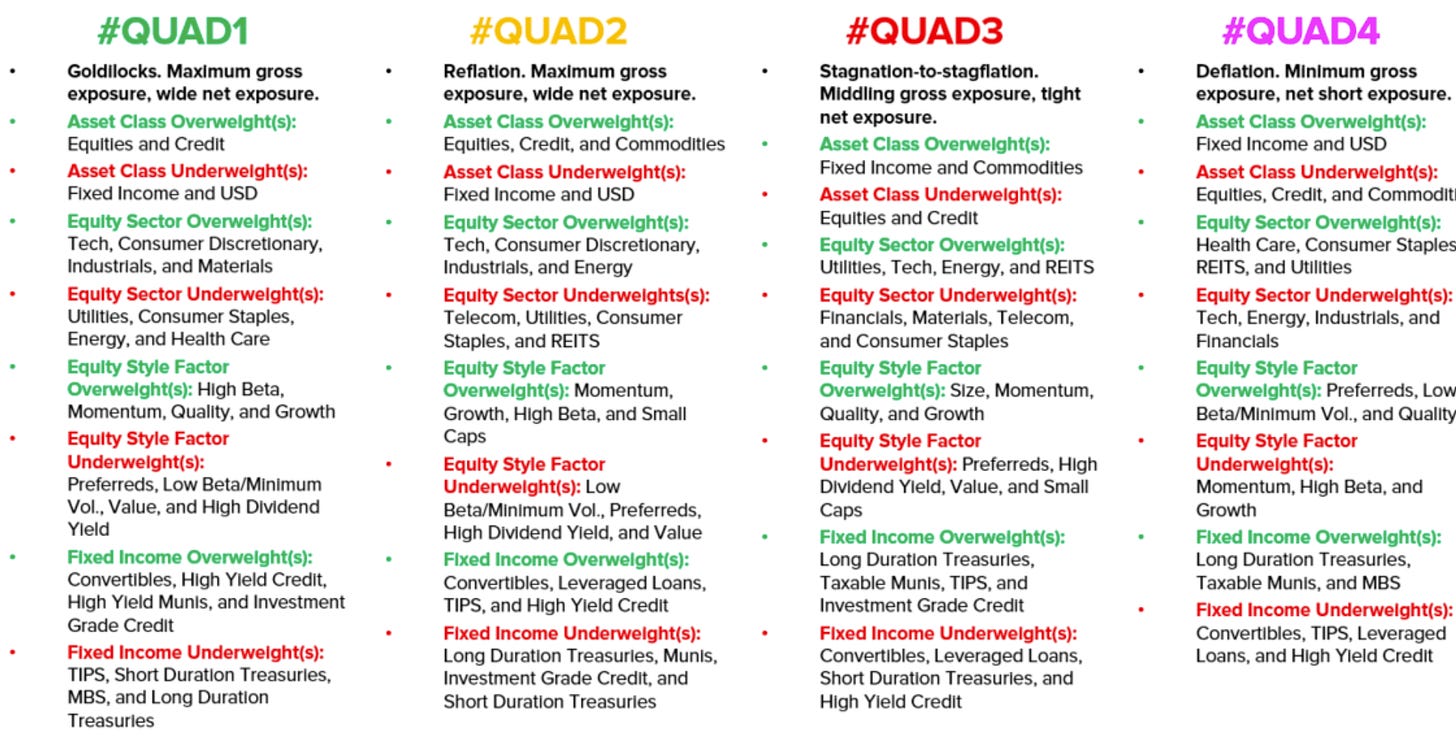

Get on the train . . . with the Quad City DJs. This Quad City that asset allocators love to use.

If stagflation is the expected outcome, a US economy hit by declining growth (still 2% mind you), and higher inflation, then we’re in Quadrant 3 (bottom right corner). There’s versions to this, but let’s just take a look at HedgeEye’s 4 quadrant chart. It’s pretty standard. So what should people invest in?

You guessed it, fixed income and commodities. Things that protect capital, and things that appreciate with inflation as hard assets become more valuable. It’s likely one of the reasons energy equities have held up despite the overall market meltdown (and no doubt also some reversal of a long tech / short-energy strategy).

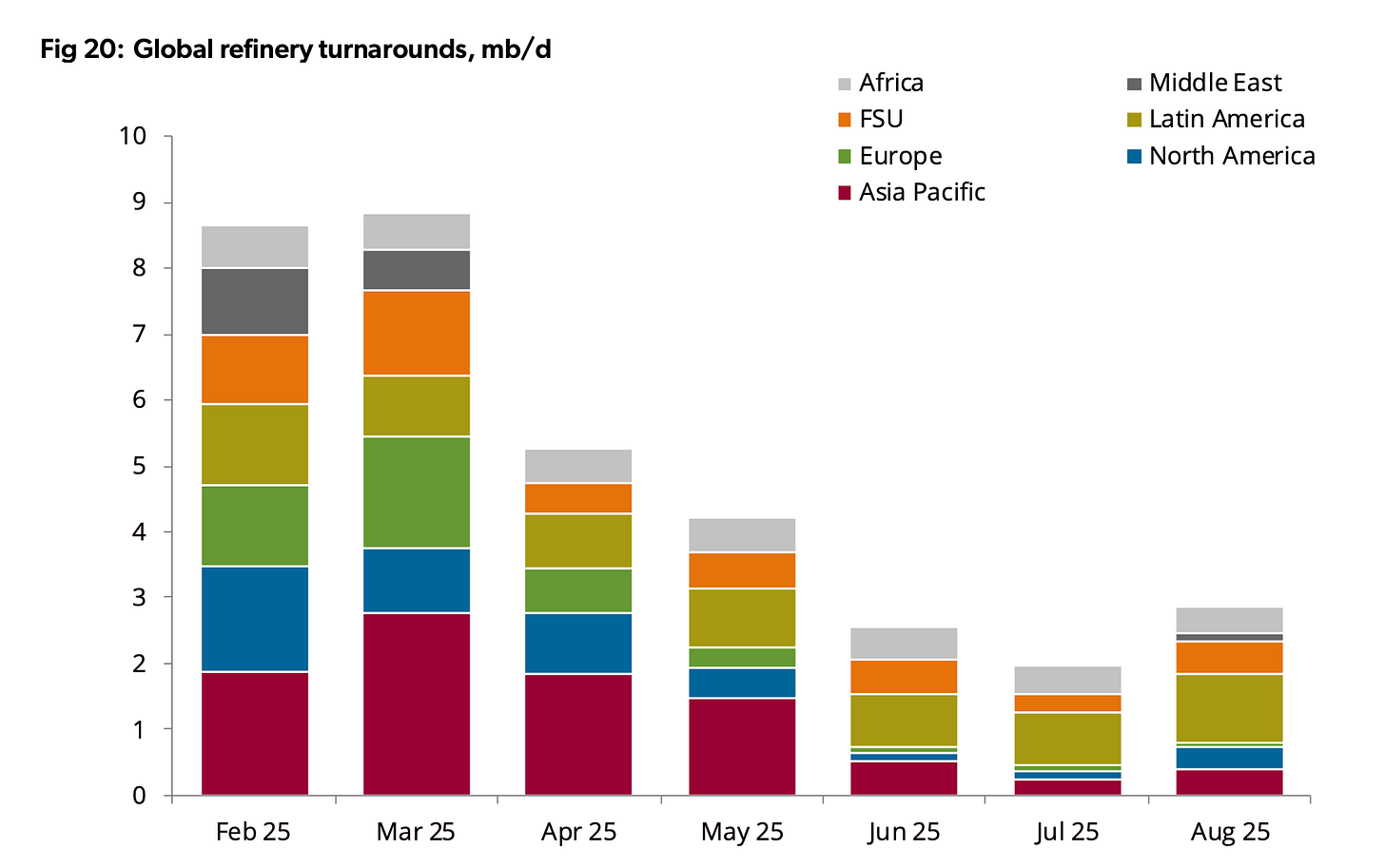

What’s interesting now though is . . . what if we fundamentally start to improve on the energy side as we emerge from the seasonal refinery maintenance season (Energy Aspects below).

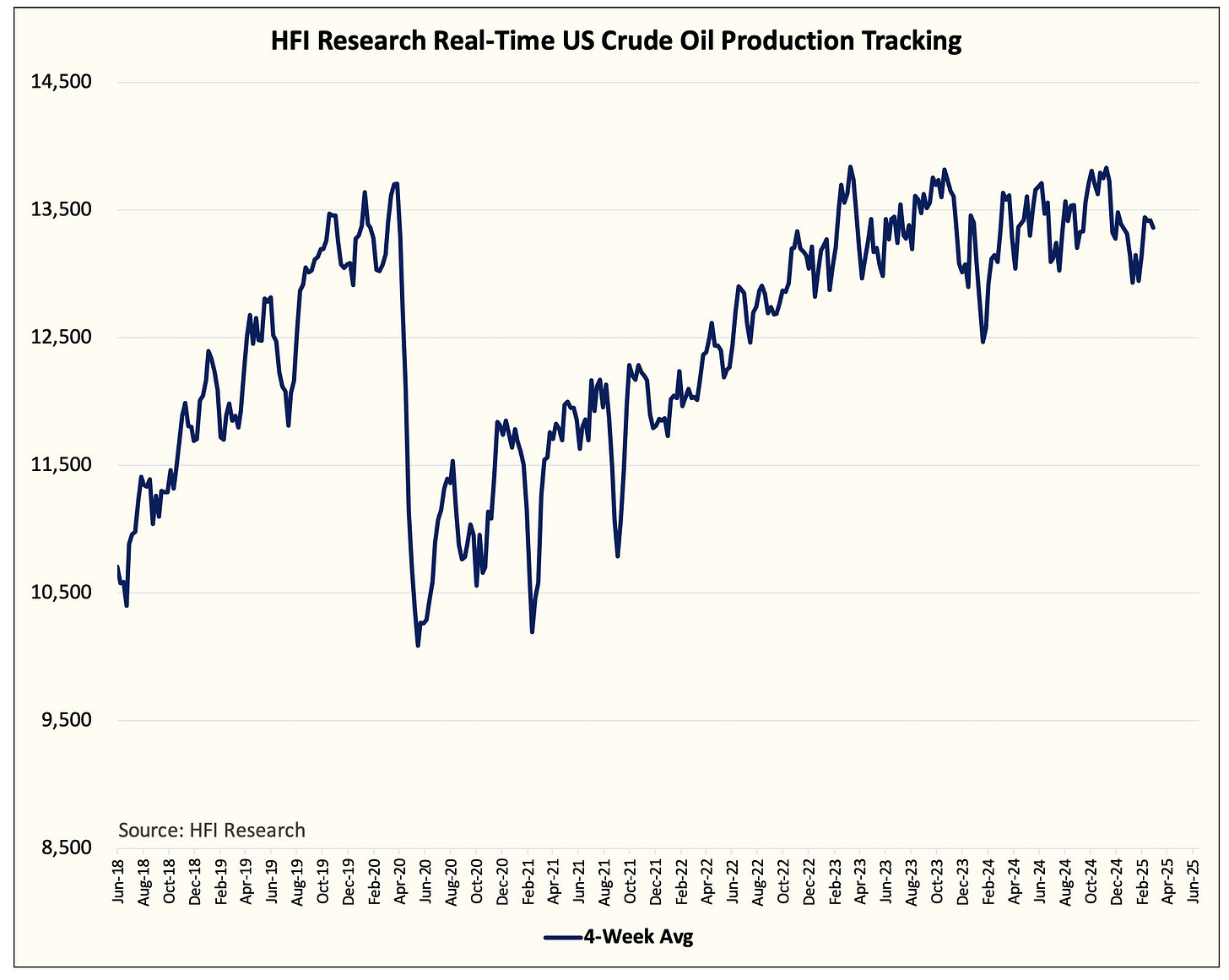

What if refineries begin to pull hard on crude as we head into April and the summer months? Just as US production growth (which is basically the vast majority of non-OPEC+ growth) begins to tip over (HFI Research)?

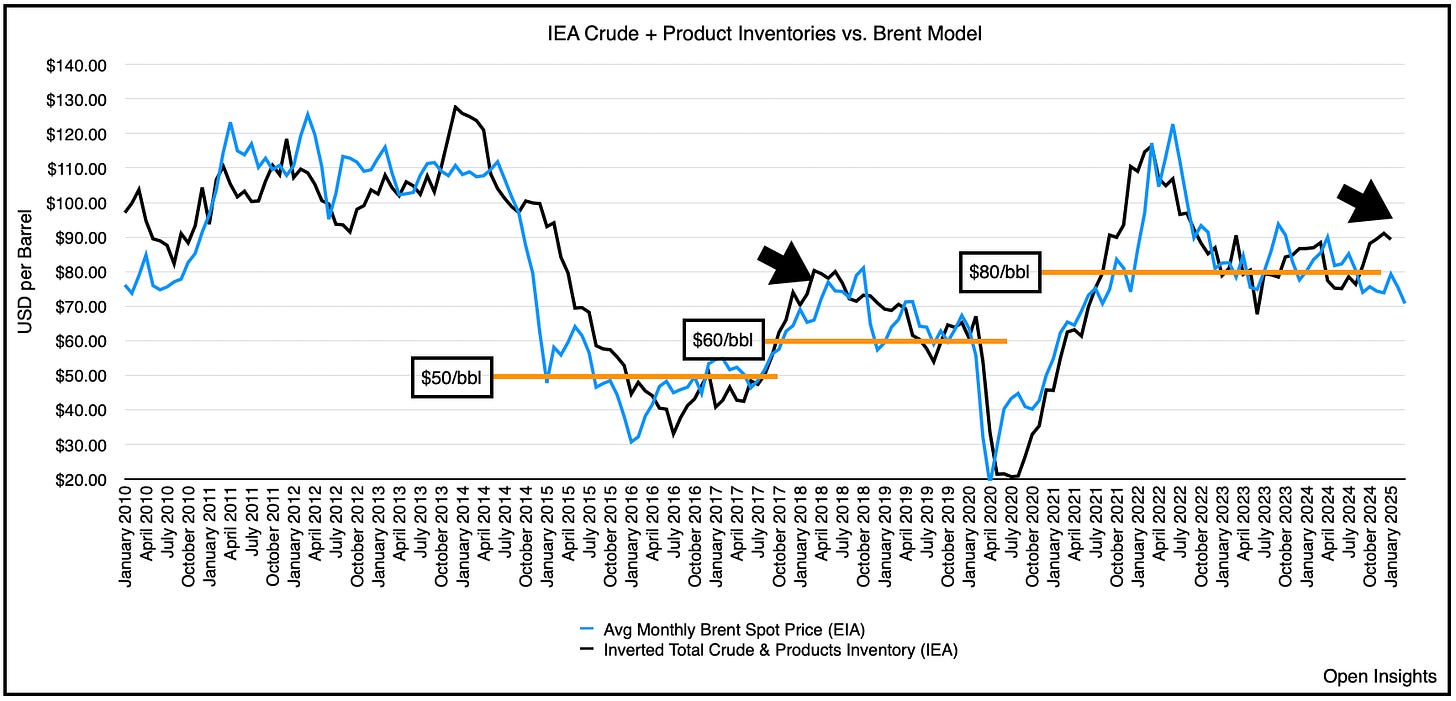

Oil at $68/barrel? We doubt that stays there for long considering oil inventories TODAY (during low demand season) warrants ~$90/barrel.

Wait though, aren’t we heading towards a recession? Will it be deep and severe if the consumer remains strong? What if trade agreements are made and the tariffs reduced, wouldn't that juice GDP? At the very least remember, oil demand is tied to GDP, and even in the stagflationary forecast, GDP growth is anticipated to be . . . 1.7%. 1.7% mind you is STRONG.

So on the base case, assume stagflation, and if that’s already providing support for energy equities, what happens when the fundamentals catch-up to the sentiment?

Choo chooooo . . . all aboard!

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Its a very difficult timeline. Everyday one tweet makes a joke out of yesterdays tweet.

We have heard an awful lot about the inflationary consequences of tariffs, but I wonder if those concerns are not being enflamed by the main stream media who are constantly looking for anything to say about President Trump that is negative. arguably, the impact of tariffs will exist, but to assume that 25% tariffs is going to raise the price of all our imports from Canada and Mexico by that much is poor math. price increases will only occur on those items that are price inelastic. for instance, Chipotle has already said they are going to absorb the higher cost of avocados, and there will be numerous instances where the price impact will be significantly lower than the headline tariff rate. second, the substitution effect will have a significant impact as well, so the all in price rises there are likely to be far less than currently feared.

however, I agree that inflation is unlikely to fall regardless, for other reasons.

on the growth side, while Q1 seems likely to have a negative GDP print given the Net Export impact, this recession, when it comes, will have been the longest awaited recession in history. certainly segments of the economy are likely to slow down, but the entire thing? I'll take the over